Gratuity, often referred to as the end-of-service benefit, is a significant financial entitlement for employees in the UAE. Governed by the UAE Labour Law, this benefit is designed to reward employees for their service and loyalty to their employers.

Whether you are just starting your career or approaching the end of your service, understanding how this benefit is calculated is crucial for effective financial planning.

This guide will explain the end-of-service system in the UAE, detail how to Gratuity calculate your entitlement, and highlight key factors influencing your benefits. By the end of this document, you’ll have a clear understanding of how it works and how to use a calculator to estimate your benefits accurately.

What Is Gratuity?

This benefit is a lump sum payment provided to employees at the conclusion of their employment, as long as they meet specific eligibility requirements. It is mandatory for employers to provide this payment under Federal Decree-Law No. 33 of 2021 regulating labour relations.

The system is applicable to full-time employees in the private sector, regardless of whether they are working under limited or unlimited contracts. This financial cushion supports employees as they transition to new roles or retire.

Eligibility for Gratuity in the UAE

To qualify for the benefit, employees must:

- Have completed at least one year of continuous service with the same employer.

- Not have been terminated for gross misconduct, as defined by UAE Labour Law.

- Comply with the terms and conditions outlined in their employment contract.

Both UAE nationals and expatriates are eligible. However, the calculation may vary based on the type of contract and duration of service.

Key Factors in Gratuity Calculation

Calculations depend on several factors:

- Basic Salary: Payments are based on the employee’s last drawn basic salary. Allowances such as housing, transportation, and other perks are excluded.

- Type of Contract: The calculation differs for limited and unlimited contracts.

- Length of Service: The total number of years an employee has worked for the employer impacts the amount.

- Reason for Termination: Whether the employee resigns or is terminated affects the calculation for unlimited contracts.

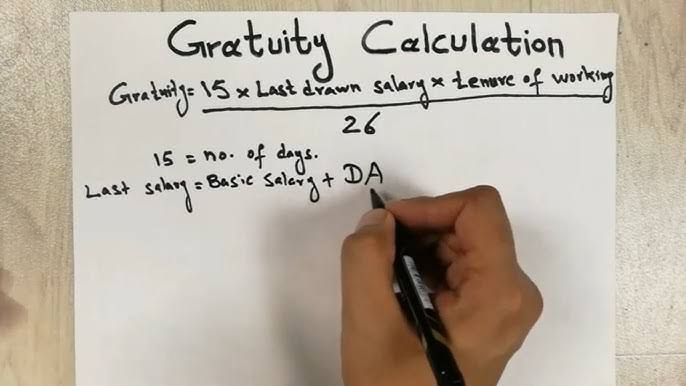

How Gratuity Is Calculated

The process differs for limited and unlimited contracts. Below are the specific rules:

1. Limited Contracts

For employees under limited contracts, the entitlement is as follows:

- 1-5 Years of Service: 21 days’ basic salary for each year of service.

- More than 5 Years of Service: 21 days’ basic salary for the first five years, plus 30 days’ basic salary for each subsequent year.

2. Unlimited Contracts

For employees under unlimited contracts, the entitlement depends on whether they resign or are terminated:

- If the Employee Resigns:

- Less than 1 Year: No entitlement.

- 1-3 Years: One-third of the entitlement.

- 3-5 Years: Two-thirds of the entitlement.

- More than 5 Years: Full entitlement.

- If the Employer Terminates the Contract: The calculation is the same as for limited contracts, with no reductions.

Using a Gratuity Calculator

An online tool can simplify the process of determining your end-of-service benefits. Here are the steps:

- Input Your Basic Salary: Enter your last drawn basic salary, excluding allowances.

- Specify Your Contract Type: Choose between a limited or unlimited contract.

- Enter Your Length of Service: Provide the total years and months worked.

- Indicate the Reason for Termination: Mention whether you resigned or were terminated, as this affects calculations for unlimited contracts.

The tool will then estimate your benefit based on UAE Labour Law.

Also Read : 9 Exciting Game-Changing Transformations in the UAE for 2025!

Example Gratuity Calculations

Example 1: Limited Contract

- Basic Salary: AED 10,000

- Service Duration: 6 years

Calculation:

- 21 days x AED 10,000 / 30 = AED 7,000 (payment per year for the first five years)

- AED 7,000 x 5 years = AED 35,000

- 30 days x AED 10,000 / 30 = AED 10,000 (payment for the sixth year)

Total: AED 35,000 + AED 10,000 = AED 45,000

Example 2: Unlimited Contract (Resignation)

- Basic Salary: AED 8,000

- Service Duration: 4 years

Calculation:

- Resigned after 4 years: Two-thirds entitlement

- 21 days x AED 8,000 / 30 = AED 5,600 (payment per year)

- AED 5,600 x 4 years = AED 22,400

- Two-thirds entitlement: AED 22,400 x 2/3 = AED 14,933.33

Special Considerations

Several factors can influence calculations:

- Deductions: Employers may deduct amounts for outstanding debts or damages caused by the employee.

- Unpaid Leave: Periods of unpaid leave may not be included in the total service duration.

- Free Zones: Employees in free zones may have specific rules, as some zones operate under their own labor regulations.

- Online Tools: Employers often provide calculators, but ensure they align with UAE Labour Law.

Common Mistakes to Avoid

- Including Allowances: Only the basic salary is considered for calculations.

- Ignoring Contract Type: The calculation rules differ significantly between limited and unlimited contracts.

- Misinterpreting Resignation Rules: Understand the reduced entitlement for resignations under unlimited contracts.

Rights and Disputes

If disputes arise over payments, employees can file a complaint with the Ministry of Human Resources and Emiratisation (MOHRE). The ministry provides mediation services to resolve conflicts and ensure compliance with labor laws.

Conclusion

The end-of-service system in the UAE underscores the country’s commitment to protecting employee rights and fostering a fair workplace.

By understanding how these benefits are calculated and using available tools, employees can ensure they receive their rightful payments.

Whether you are a long-term employee or new to the workforce, staying informed about your entitlements can help you plan your financial future with confidence.

By preparing and using a calculator effectively, you can navigate the system seamlessly and ensure your hard work is appropriately rewarded.

Do follow Uae stories for more update

The New Gold Souk Dubai: A Shimmering Jewel of Modern Luxury