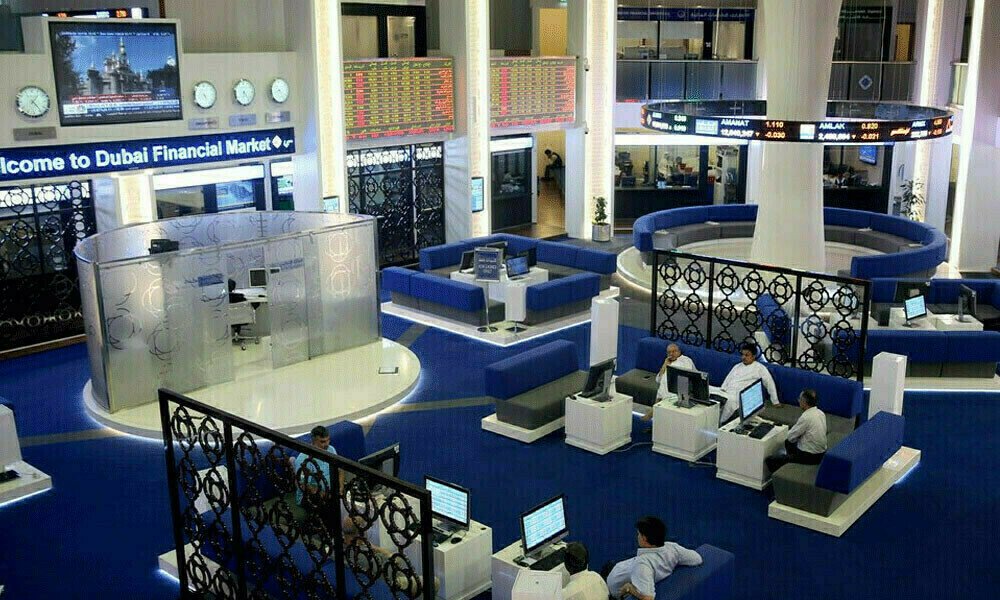

Strong optimism drives UAE stock market higher

The UAE stock market experienced a notable rise this week as investors responded positively to renewed hope for trade discussions between the United States and China. After months of global market uncertainty, signs of diplomatic movement between the two major economies injected fresh energy into regional trading floors.

In Dubai and Abu Dhabi, the main indexes closed higher as optimism surrounding easing trade tensions helped lift both large-cap stocks and sectors tied to international trade and logistics. The boost also reflects wider investor confidence in the region’s economic resilience.

Global developments bring fresh momentum

Markets across the Gulf have been closely watching the global trade narrative. When news emerged of upcoming diplomatic engagements between the US and China, the UAE stock market reacted almost immediately.

The Dubai Financial Market (DFM) saw a nearly 2% jump in trading volume, while the Abu Dhabi Securities Exchange (ADX) followed closely with a 1.5% uptick by end-of-day closing. Blue-chip stocks such as Emaar Properties and Emirates NBD posted healthy gains, with both seeing upward movement in share prices.

Key sectors benefiting from trade optimism

Logistics and shipping companies led the charge as they are directly impacted by global trade conditions. DP World, one of the UAE’s major global trade enablers, saw a steady rise in investor interest. Likewise, financial and real estate sectors rebounded after weeks of lukewarm performance.

Investors appear to be pricing in a smoother global trade flow in the near future, which could benefit UAE ports, export hubs, and even retail, particularly as the country ramps up to host major regional events later this year.

Why trade talks matter to the UAE

The UAE, being a global trade and financial hub, is deeply linked to international markets. Any sign of relief in global trade tensions typically translates into higher regional investment, smoother commodity flows, and a stronger local currency.

A potential agreement or even a framework for dialogue between the US and China would directly benefit the UAE’s export-import dynamics. Ports in Dubai and Abu Dhabi serve as critical transit points for global goods, so improving trade routes can drive up activity levels across multiple sectors.

Investor confidence sees a strong rebound

The recent market reaction is not only about external trade relations; it also reflects the growing trust in the UAE’s economic management. Government initiatives to attract foreign investment, diversify the economy, and improve transparency have helped the market become more resilient to global shocks.

Institutional investors were particularly active this week, with renewed interest in long-term plays across energy, finance, and infrastructure. Analysts suggest this trend could continue if geopolitical news remains stable and economic indicators in the region hold strong.

Regional indices move in sync

Beyond the UAE, markets in Saudi Arabia, Qatar, and Bahrain also showed upward momentum. However, the UAE stock market stood out due to its diversified exposure and active global partnerships. The performance of the DFM and ADX indexes was among the top in the region this week.

The close economic relationships between Gulf nations mean positive sentiment in one country often spills over into neighboring markets. However, the UAE’s open trade policies and strategic geographic location give it an extra advantage in times of global uncertainty.

Cautious optimism still dominates

While the market reaction was largely positive, experts urge investors to remain cautious. The trade talks are still in the planning phase, and actual negotiations could take time to yield results. There is also the risk of renewed tensions or breakdowns in dialogue that could reverse gains quickly.

Despite this, the underlying fundamentals of the UAE stock market remain strong. Corporate earnings have been stable, oil prices have held steady, and the country continues to roll out major economic reform initiatives designed to boost long-term growth.

What’s next for UAE investors?

As the next quarter approaches, all eyes will be on continued global trade developments, local policy announcements, and earnings reports from key listed companies. Many analysts suggest that this is a good time for medium to long-term investors to watch for entry points, especially in undervalued sectors such as tourism, fintech, and green energy.

For retail investors in the UAE, platforms like DFM and ADX offer updates on real-time market movements and listed company news. Meanwhile, broader economic trends can be tracked through government sources and major media outlets.

The road ahead: resilience through diversity

The UAE’s ability to weather global economic uncertainty continues to be one of its greatest strengths. By investing in infrastructure, technology, and economic diversification, the country has positioned itself to benefit not just from global trade recovery but also from emerging sectors.

As long as regional stability holds and diplomatic efforts between major powers progress, the UAE stock market could continue its upward journey, bringing renewed hope and opportunity for investors across the Emirates.

Read More: UAE Off-Plan Property Market: 10 Smart Reasons to Invest & What to Know Before Buying