The UAE central bank AML fine has recently made headlines, following the regulator’s decision to impose a hefty penalty of AED 3 million on a local bank. This significant move underscores the United Arab Emirates’ ongoing commitment to fighting money laundering and financing of terrorism.

Why the UAE takes AML compliance so seriously

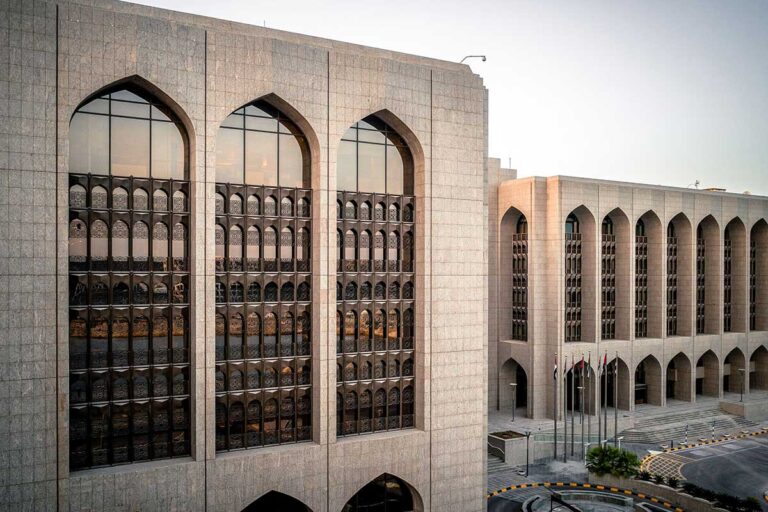

The UAE has long been recognized as a major global financial hub. With its strategic location, advanced infrastructure, and strong financial system, the country attracts investors and businesses from all over the world. However, this same attractiveness also makes it a potential target for illicit financial activities.

To protect its reputation and ensure economic stability, the UAE has been rigorously strengthening its anti-money laundering (AML) and counter-terrorism financing (CTF) framework. The UAE authorities have committed to align with international standards set by the Financial Action Task Force (FATF), a global watchdog that sets rules to combat money laundering and terrorist financing.

The recent UAE central bank AML fine is a prime example of the authorities’ zero-tolerance approach toward financial crime.

Details of the AED 3 million penalty

On July 8, 2025, the Central Bank of the UAE announced a fine of AED 3 million on an unnamed local bank. According to the statement, the penalty was imposed due to the bank’s failure to achieve adequate compliance with AML regulations.

The violations included:

- Failure to identify and report suspicious transactions

- Weak internal controls and inadequate due diligence measures

- Poor monitoring of customer activities

- Deficiencies in record-keeping and reporting mechanisms

The UAE Central Bank clarified that these shortcomings posed significant risks to the integrity of the country’s financial system. By imposing this fine, the regulator aims to deter other financial institutions from neglecting their AML obligations.

Historical context: UAE’s AML journey

The UAE’s efforts to enhance AML controls did not start overnight. Over the past decade, the country has taken significant strides to improve financial sector transparency.

In 2020, the UAE introduced Federal Decree-Law No. 20 of 2018 on AML and CTF, which required financial institutions to implement stringent measures to identify and mitigate money laundering risks.

Moreover, the country set up a specialized Executive Office to combat money laundering and terrorist financing. The creation of this office was a critical milestone, further signaling the government’s dedication to protecting the financial system.

The UAE central bank AML fine reflects this evolving regulatory landscape, where the authorities actively penalize non-compliance rather than just issuing warnings.

What does this mean for banks operating in the UAE?

The AED 3 million fine serves as a wake-up call for all banks and financial institutions operating in the UAE. In today’s highly regulated environment, ignoring AML and CTF guidelines can lead to severe financial and reputational consequences.

Financial institutions must:

- Implement strong customer due diligence (CDD) procedures

- Monitor transactions continuously to detect unusual or suspicious activity

- Maintain up-to-date records of all financial transactions

- Train employees regularly on AML requirements and red flags

Non-compliance not only leads to fines but can also damage a bank’s credibility with customers, investors, and global partners.

The global impact of UAE’s strict AML measures

The UAE central bank AML fine is not just a local affair; it has broader implications globally. As a major international financial center, the UAE hosts numerous multinational corporations, investment funds, and high-net-worth individuals.

When the UAE strengthens its AML framework, it:

- Enhances investor confidence

- Reduces the likelihood of being blacklisted or grey-listed by global watchdogs

- Encourages healthy cross-border financial relationships

- Improves the overall reputation of the Gulf region

Such strict actions demonstrate to the world that the UAE is committed to maintaining a safe and transparent financial ecosystem.

Challenges in AML compliance

Despite advancements, AML compliance remains challenging for many financial institutions. The fast-paced development of financial technologies, the rise of crypto-assets, and the complexity of global transactions make it difficult to track illicit activities effectively.

Some common challenges include:

- Limited access to reliable data on customers and transactions

- Rapidly changing money laundering techniques and methods

- Balancing strict compliance with customer experience and privacy concerns

- High costs associated with implementing advanced monitoring systems

Nevertheless, regulators expect banks to adapt and invest in the necessary technology and expertise.

Recent examples of AML enforcement in the UAE

The AED 3 million fine is not an isolated event. The UAE has stepped up its AML enforcement efforts in recent years. For instance:

- In 2022, several exchange houses were fined for similar AML breaches

- In 2023, a major UAE-based bank was fined AED 19.5 million for severe deficiencies in its AML program

- In 2024, the Central Bank imposed fines on insurance companies that failed to implement adequate due diligence procedures

These actions demonstrate a consistent and aggressive approach to enforcing AML regulations.

Importance of internal AML frameworks

The foundation of any bank’s AML compliance lies in its internal framework. This includes policies, procedures, and controls designed to prevent, detect, and report money laundering.

Key elements of an effective AML framework:

- Risk assessment: Identifying and assessing risks associated with different customer types, products, and geographies

- Know Your Customer (KYC): Collecting accurate information on customers’ identity, business nature, and source of funds

- Transaction monitoring: Using automated systems and manual checks to spot unusual patterns

- Suspicious activity reporting: Promptly reporting any suspicious activities to the relevant authorities

- Regular audits: Ensuring continuous improvement and adherence to regulatory expectations

With these measures, banks can mitigate risks and avoid penalties like the recent UAE central bank AML fine.

Strengthening the compliance culture

While frameworks and technologies are crucial, fostering a strong compliance culture is equally important. Leadership should set the tone from the top, emphasizing ethical practices and zero tolerance for violations.

Banks must encourage employees to speak up about potential misconduct without fear of retaliation. Continuous training, open communication, and clear policies are key to achieving this.

Future outlook: What’s next after the AED 3 million fine?

The UAE central bank AML fine sets the tone for future regulatory actions. Experts expect:

- Increased on-site inspections and audits by the Central Bank

- More stringent licensing and operational requirements for financial institutions

- Higher investment in compliance technology, such as AI-driven monitoring tools

- Greater collaboration between local and international regulatory bodies to track cross-border illicit flows

Banks that proactively strengthen their AML programs will likely gain a competitive advantage, as they become more trustworthy partners for global transactions.

The role of technology in AML compliance

The integration of technology is vital in modern AML efforts. Advanced solutions like machine learning, data analytics, and blockchain monitoring tools help financial institutions detect suspicious activities faster and more accurately.

Benefits include:

- Real-time transaction monitoring

- Automated risk scoring of clients

- Enhanced reporting and analytics

- Improved customer onboarding through e-KYC systems

Embracing technological innovation can significantly reduce the burden of manual checks and improve overall efficiency.

Public perception and trust

The UAE central bank AML fine also plays an important role in shaping public perception. Customers today are more aware and concerned about the integrity of financial institutions they trust with their money.

When regulators take decisive actions against non-compliance, it strengthens public trust in the system. People feel more confident that their assets are safeguarded and that their banks are not indirectly supporting illicit activities.

Strengthening regional and global partnerships

The UAE’s robust stance on AML compliance also enhances its relationships with other countries and international organizations. It facilitates smoother cross-border banking and trade activities and ensures that UAE-based financial institutions are viewed as reliable and compliant partners globally.

This is particularly important for the UAE, as it aims to further diversify its economy and establish itself as a global business hub.

Lessons for smaller banks and financial institutions

While large banks often have the resources to implement sophisticated AML programs, smaller institutions may find it more challenging. However, the UAE central bank AML fine makes it clear that no entity is exempt from compliance obligations.

Smaller banks and exchange houses should consider:

- Outsourcing certain compliance functions if in-house expertise is lacking

- Partnering with specialized firms to enhance transaction monitoring

- Conducting regular training for all employees, regardless of size or scope

- Establishing a strong relationship with regulators and proactively seeking guidance

Conclusion: Compliance as a business priority

The AED 3 million UAE central bank AML fine is more than just a financial penalty; it is a strong message to the entire financial sector. Compliance with AML and CTF regulations should not be seen merely as a legal requirement but as an essential business priority.

Banks and financial institutions must invest in robust frameworks, embrace new technologies, and cultivate a strong compliance culture from the top down.

Only then can they ensure long-term sustainability, protect their reputation, and contribute to a safe and transparent financial ecosystem that aligns with both national and international expectations.

Follow us on Instagram: UAE STORIES

Read More: Discover the UAE’s Iconic Cultural Landmarks That First-Time Visitors Simply Can’t Miss