A Meeting Shaping the Future of the UAE’s Financial Landscape

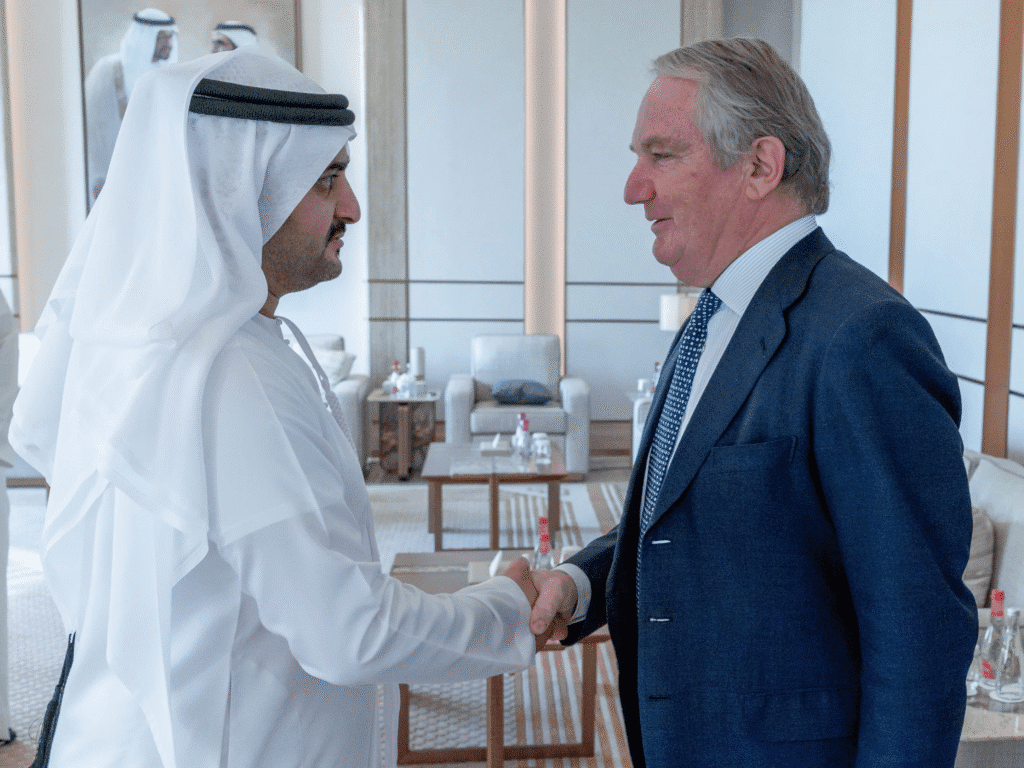

Sheikh Maktoum Bin Mohammed Bin Rashid Al Maktoum, First Deputy Ruler of Dubai, Deputy Prime Minister and Minister of Finance, recently met with Alexander Wynaendts, Chairman of the Supervisory Board of Deutsche Bank AG. The meeting took place at Sheikh Maktoum’s office and highlighted the growing confidence the UAE has in its financial sector. It also underlined the country’s ambition to deepen cooperation with some of the world’s leading international banks.

The discussion centred around the rapid transformation taking place within the UAE’s banking system. Sheikh Maktoum spoke about how the country is entering a new phase of strong financial expansion, driven by technological advancements and a strategic focus on digital transformation. He emphasised that the UAE’s banking landscape is evolving into one of the most modern and stable ecosystems globally, making it increasingly attractive for international financial institutions.

The UAE’s Banking Sector Enters a High-Growth Phase

Sheikh Maktoum highlighted that the UAE’s financial sector is benefitting from continuous upgrades in governance, regulations, financial technology and infrastructure. These improvements are allowing both local and international banks to operate within a system that values transparency, trust, efficiency and technological advancement.

He explained that the country’s strong digital banking systems, enhanced fintech adoption and investment-friendly regulations are helping shape a new era for the UAE’s economy. As global financial markets become more integrated and competitive, the UAE aims to remain ahead by supporting innovation and welcoming international financial institutions to expand their services in the region.

The UAE’s progress in digital transformation has allowed banks to improve customer experience, secure financial transactions more effectively and build stronger data-driven systems. This shift also aligns with the UAE’s broader economic ambitions, which aim for long-term stability and sustainable development across all sectors.

Dubai’s Position as a Global Financial Hub Continues to Strengthen

A significant part of the conversation focused on Dubai’s growing role as a central hub for global finance, investment and capital flows. Over the years, Dubai has positioned itself as a bridge between major international markets, making it a natural choice for multinational banks and corporations seeking regional and global expansion.

Sheikh Maktoum and Wynaendts discussed how Dubai’s well-established infrastructure, strategic location, business-friendly environment and regulatory frameworks continue to attract investors from around the world. The city has become a preferred destination for international banks due to its stability, modern facilities, financial expertise and attractive economic opportunities.

Dubai’s financial ecosystem, including the Dubai International Financial Centre (DIFC), has played a significant role in strengthening its global status. DIFC is home to hundreds of global financial companies, investment firms and regulatory bodies, creating a vibrant and interconnected environment for financial services.

Support for International Financial Institutions

The UAE has consistently shown its commitment to offering an attractive and competitive ecosystem for international banks. During the meeting, Sheikh Maktoum underlined the importance of strengthening partnerships with global financial institutions, as these relationships bring knowledge, expertise and new investment opportunities to the country.

The discussion highlighted the UAE’s dedication to promoting economic stability, fostering long-term financial partnerships and creating a business climate that supports innovation. Sheikh Maktoum reiterated that collaborations with institutions such as Deutsche Bank are vital for achieving the country’s strategic goals, especially those linked to the Dubai Economic Agenda D33.

The D33 Agenda aims to double Dubai’s GDP by 2033 and position the city among the world’s top three urban economies. Part of this ambitious plan includes strengthening Dubai’s role as a global financial centre and enhancing the competitiveness of its banking sector. Establishing deeper partnerships with international banks is a key component of this vision.

Deutsche Bank’s Role in Global Finance and Regional Development

Deutsche Bank AG is one of the world’s leading financial institutions, with a history dating back to 1870. It operates in 56 countries and employs around 90,000 people globally. During the meeting, Alexander Wynaendts highlighted the bank’s global performance and outlined its continued efforts to support financial growth across its international markets.

As of the end of the third quarter of 2025, Deutsche Bank reported strong financial performance. Its Asset Management division recorded €1.054 trillion in assets under management, while its Private Banking division managed €675 billion. The bank’s overall net revenues grew by 4 percent in 2024, reaching €30.1 billion.

In the Middle East and Africa region, Deutsche Bank operates from its main hub at the Dubai International Financial Centre. From this strategic base, the bank provides investment banking, transaction banking, private wealth management and asset management services. The DIFC hub allows Deutsche Bank to serve a diverse range of clients across the region, including government institutions, multinational corporations and high-net-worth individuals.

The bank’s growing presence in Dubai reflects its confidence in the UAE’s financial stability, regulatory strength and long-term economic vision. It also highlights Dubai’s emergence as a leading platform for international banks looking to expand their operations in global markets.

Strengthening Dubai’s Financial Future

The meeting also included high-level UAE officials, reinforcing the importance of the discussions. Participants included Mohamed Bin Hadi Al Hussaini, Minister of State for Financial Affairs; Helal Almarri, Director-General of the Dubai Department of Economy and Tourism; Essa Kazim, Governor of DIFC; and Hesham Abdulla Al Qassim, Vice Chairman and Managing Director of Emirates NBD.

Their presence emphasised the UAE’s coordinated approach to supporting international financial institutions and enhancing Dubai’s role as a global financial centre. Each official contributed insights into how Dubai is shaping its financial future through policy reforms, regulatory advancements and infrastructure development.

The UAE continues to prioritise innovation-driven financial services, digital transformation and strategic partnerships. This approach not only strengthens Dubai’s competitive position but also contributes to the wider regional economy.

Looking Ahead: A Shared Vision for Growth

The meeting between Sheikh Maktoum and Alexander Wynaendts represents an important step in advancing the UAE’s long-term economic goals. By deepening collaboration with Deutsche Bank, the UAE reaffirms its commitment to building a resilient, innovative and forward-looking financial sector.

As the UAE continues to experience rapid economic transformation, partnerships with global institutions will play a key role in shaping its financial landscape. The country’s strong regulatory framework, digital infrastructure and global connectivity position it as a rising financial powerhouse.

The UAE’s growth in the financial sector is expected to continue, driven by investments in technology, strategic global partnerships and a clear vision for the future. With Dubai’s economic agenda shaping the next decade, the country is set to become an even more influential player in international finance.

The meeting stands as a strong signal that the UAE and its financial leaders are moving confidently toward a future defined by innovation, collaboration and sustainable economic growth.

Do follow UAE Stories on Instagram

Read Next – Al Etihad Parade to Bring Dubai Together for Union Day