RAK property market 2025 is witnessing a significant surge, with residential property prices reaching unprecedented levels. Apartments are now nearing Dh2,000 per square foot, while villas are approaching Dh1,200 per square foot. This rise is fueled by growing demand, limited supply, and ongoing infrastructure development in the emirate. Ras Al Khaimah is fast emerging as a key investment destination in the UAE, attracting both local and international buyers.

Market Dynamics: Price Surge and Demand

In early 2025, Ras Al Khaimah’s real estate market recorded a year-on-year price increase of nearly 39 percent. The luxury segment, especially developments on Al Marjan Island, is a major driver of this growth. Apartments now average around AED 1,684 per square foot, while villas average AED 1,145 per square foot. The launch of high-end projects has pushed overall price benchmarks higher, creating a strong momentum in the market.

Rental trends have also mirrored the sales growth, with rents rising by around 5 percent in the second quarter of 2025. Mina Al Arab recorded the highest rent growth at 12.4 percent, while villa rents increased by 6 percent. These figures reflect strong economic activity, population growth due to new job opportunities, and a relatively low number of new units entering the market, with only 570 units delivered in 2025 so far compared to over 1,800 units in 2024.

Infrastructure Developments and Future Outlook

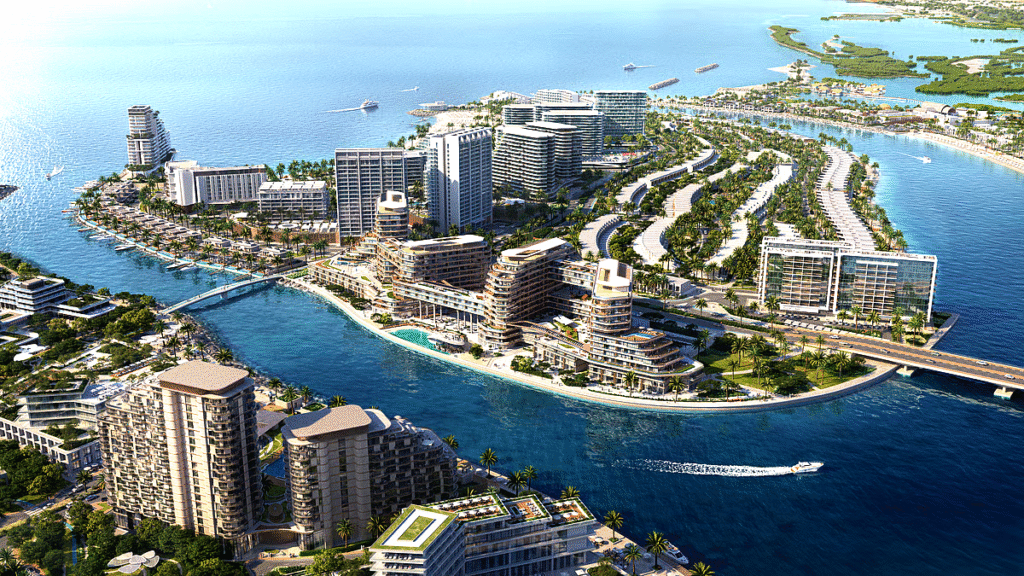

Significant infrastructure projects are further boosting the RAK property market 2025. The upcoming $3.8 billion Wynn Resort on Al Marjan Island is expected to enhance both tourism and real estate demand. Analysts project that property prices could rise substantially by 2030, potentially reaching AED 10,000 per square foot in prime locations.

Additionally, the residential stock in Ras Al Khaimah is projected to double by 2030, with over 11,000 units scheduled for completion. This expansion is expected to meet the growing demand, especially from investors looking for high returns in emerging markets. The combination of strategic development and careful urban planning is likely to keep RAK property prices on an upward trajectory.

Investment Opportunities and Neighborhood Insights

RAK property market 2025 offers attractive investment opportunities. Apartments on Al Marjan Island currently provide an average return on investment (ROI) of 5.75 percent. Off-plan properties are particularly popular, offering expected appreciation rates of 12–15 percent, and entry prices that are around 20 percent lower than ready-to-move-in units.

Key neighborhoods such as Al Marjan Island, Al Hamra Village, and Mina Al Arab are experiencing strong price growth. Al Marjan Island is in high demand due to its luxury developments and proximity to the Wynn Resort. Al Hamra Village and Mina Al Arab are preferred by investors seeking both rental yields and long-term capital appreciation.

Developer Activity and Market Confidence

Leading developers in Ras Al Khaimah are reporting strong financial performance, reflecting growing confidence in the market. RAK Properties, for instance, saw a 27 percent increase in revenue to AED 774.79 million for the first half of 2025. Net profit surged by 80 percent to AED 160.60 million compared to the previous year, while sales value doubled to AED 1,411 million.

This growth underlines the emirate’s appeal as a high-potential investment destination. Developers are actively expanding projects and planning new launches to meet the rising demand, while investors are confident about both short-term returns and long-term capital appreciation.

Lifestyle Appeal and Expat Attraction

Ras Al Khaimah offers a unique combination of natural beauty and modern living. With scenic beaches, mountains, and a tranquil environment, the emirate is increasingly popular among expatriates and investors alike. Benefits such as no income tax, no capital gains tax, and 100 percent foreign ownership rights make it even more appealing.

The growing expatriate community, particularly from Dubai, Abu Dhabi, Europe, China, and the US, is driving demand for residential properties. Many are looking for high-quality housing without paying the premium prices associated with Dubai, making RAK an attractive alternative.

Future Prospects and Market Predictions

Looking ahead, the RAK property market 2025 shows strong growth potential. Rising property prices, robust rental yields, and major infrastructure projects all point toward continued expansion. Analysts predict that demand for high-end residential properties will remain strong, particularly in areas such as Al Marjan Island and Al Hamra Village.

With over 11,000 new units expected by 2030 and further tourism-driven developments on the horizon, Ras Al Khaimah is set to become a key player in the UAE real estate sector. Investors can expect steady price appreciation, while residents enjoy a high quality of life in a growing, modern emirate.

Conclusion

RAK property market 2025 is characterized by strong growth, fueled by increasing demand, limited supply, and strategic development projects. Apartment prices approaching Dh2,000 per square foot and villa prices nearing Dh1,200 per square foot reflect the market’s upward trajectory.

Ras Al Khaimah’s unique lifestyle appeal, investor-friendly policies, and strong rental potential make it an attractive destination for both investors and residents. With continued development and infrastructure expansion, the emirate is set to strengthen its position as a central hub in the UAE real estate market over the coming years.

Do follow UAE Stories on Instagram

Read Next – Aster Volunteers Mobile Medical Units Reach Rwanda and Uganda