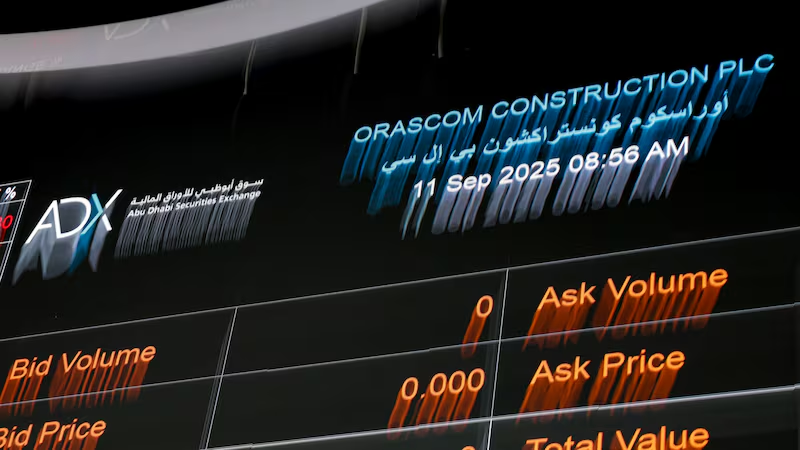

Orascom Construction ADX debut was met with remarkable enthusiasm from investors, as shares of the Egyptian engineering and construction giant soared significantly during their first day of trading on the Abu Dhabi Securities Exchange (ADX). The surge marks a milestone for Orascom Construction, signaling both investor confidence and the company’s strategic push to strengthen its presence in the Gulf and broader MENA region.

The company, long known for its infrastructure and large-scale construction projects across Egypt, the Middle East, and the United States, leveraged its debut on ADX to increase visibility and attract a wider base of investors. This move is more than just a financial step; it represents a carefully calculated strategy aimed at positioning the company as a key player in one of the most dynamic investment markets in the region.

Transitioning to the Abu Dhabi Securities Exchange

Orascom Construction’s decision to list on ADX came after a detailed review of its growth strategy and regional ambitions. Previously, the company held its primary listing on Nasdaq Dubai, which allowed it to access regional and international investors. However, the leadership team recognized the potential benefits of ADX, including greater liquidity, a larger investor base, and enhanced exposure in one of the Gulf’s fastest-growing financial markets.

The transition required shareholder approval, which was obtained during an Extraordinary General Meeting. Along with the move, the company also decided to relocate its incorporation from the Dubai International Financial Centre (DIFC) to the Abu Dhabi Global Market (ADGM). This strategic shift reflects Orascom Construction’s intent to align its corporate structure with its market presence, while maintaining its secondary listing on the Egyptian Exchange (EGX). The dual listing ensures the company continues to retain strong connections with its home country while expanding its reach in the UAE.

First-Day Trading Performance

The market response to Orascom Construction ADX debut was overwhelmingly positive. Shares opened at AED 31.7 and surged dramatically during the first hours of trading, reaching as high as AED 46 at mid-morning. By the close of the day, shares settled at AED 38.1, representing a gain of over 26% from the opening price. This jump in share price not only reflected strong market demand but also gave the company a market capitalization of around AED 4.2 billion (approximately USD 1.14 billion).

The impressive debut indicates that investors view Orascom Construction as a robust and reliable player with strong fundamentals and significant growth potential. Analysts and market participants noted that the company’s extensive portfolio of ongoing projects, its financial stability, and its reputation for delivering high-quality infrastructure projects were key factors driving the surge.

Strategic Implications of the Listing

Listing on ADX is a major strategic move for Orascom Construction. Beyond the immediate financial benefits, it positions the company to tap into the UAE’s vibrant investment ecosystem. The UAE market is characterized by high liquidity, sophisticated investors, and substantial capital inflows, all of which create an environment that supports the growth ambitions of large construction firms.

From a strategic standpoint, Orascom Construction aims to use the proceeds and market exposure from the ADX listing to fund ambitious infrastructure projects. These include large-scale industrial developments, high-end commercial projects, and critical infrastructure works in the MENA region and the United States. The company’s leadership views the ADX presence as a springboard for further expansion, allowing it to leverage regional opportunities more effectively.

The listing also strengthens Orascom Construction’s regional credibility. By moving to ADX, the company demonstrates a commitment to transparency, regulatory compliance, and corporate governance, which are crucial factors for attracting institutional investors. This strategic positioning helps Orascom Construction secure partnerships and contracts, particularly in the Gulf, where international clients often prioritize reliability and stability in their choice of construction partners.

Financial Health and Growth Prospects

Orascom Construction has demonstrated robust financial performance in recent years, contributing to its positive market reception. The company reported a significant increase in net profits, reflecting successful project execution, operational efficiency, and effective cost management. Revenue growth has been steady, supported by a diversified portfolio of projects across multiple sectors, including infrastructure, energy, industrial facilities, and high-end real estate developments.

The company also maintains a substantial backlog of contracts, providing visibility into future revenue streams. This contract pipeline includes projects valued at several billion dollars across the MENA region and the United States. The size and diversity of the portfolio not only mitigate risk but also ensure long-term growth potential, which has been a major factor in investor confidence.

Moreover, Orascom Construction has strategically positioned itself to benefit from regional growth trends. The UAE and broader Gulf region are investing heavily in infrastructure, energy, and industrial development, creating opportunities for companies with the technical expertise and financial stability to execute large-scale projects. Orascom Construction’s experience and track record make it well-positioned to capitalize on these developments, reinforcing the positive sentiment around its ADX debut.

Investor Sentiment and Market Reception

The surge in Orascom Construction’s share price on ADX reflects a broader positive sentiment in the market. Investors are increasingly looking for stable companies with growth potential in sectors like infrastructure and construction, which are less volatile and provide long-term returns. Orascom Construction’s established reputation and proven project execution record make it an attractive option for both institutional and retail investors.

Investor sentiment was further boosted by the company’s proactive communication strategy leading up to the listing. Clear explanations of its strategic goals, financial performance, and expansion plans helped build trust and credibility, ensuring a smooth and successful debut. The market response demonstrates that investors are confident not only in the company’s current performance but also in its long-term growth trajectory.

The Broader Market Context

Orascom Construction ADX debut occurs at a time when the UAE capital markets are experiencing strong investor activity. The Abu Dhabi Securities Exchange has been growing steadily, attracting listings from major regional and international companies. This environment provides a favorable backdrop for companies seeking to raise capital and expand their market presence.

Furthermore, the regional economy is benefiting from large-scale infrastructure investments and economic diversification initiatives. These developments create a positive outlook for construction companies, particularly those with expertise in complex infrastructure and industrial projects. By listing on ADX, Orascom Construction positions itself to take advantage of this growth and secure contracts that can drive revenue for years to come.

Long-Term Implications for Orascom Construction

The successful debut on ADX is expected to have several long-term implications for Orascom Construction. Firstly, it strengthens the company’s access to capital markets, providing a platform for future fundraising if needed. Secondly, it enhances brand visibility in the UAE and GCC markets, which is crucial for securing large-scale contracts.

The move also reflects a broader shift in the company’s growth strategy. By focusing on regional expansion and leveraging financial markets in the UAE, Orascom Construction is positioning itself as a leading construction and engineering firm in the MENA region. This strategic alignment is likely to attract both investors and clients, creating a virtuous cycle of growth and opportunity.

Additionally, the listing demonstrates Orascom Construction’s commitment to transparency, governance, and regulatory compliance. These qualities are increasingly valued by investors, particularly in the Gulf region, where corporate governance standards are becoming more stringent. By meeting these expectations, the company enhances its credibility and opens doors to new business partnerships.

Conclusion

Orascom Construction ADX debut marks a significant milestone in the company’s journey. The impressive surge in share price reflects investor confidence in the company’s financial health, strategic vision, and growth potential. By leveraging the opportunities offered by the Abu Dhabi Securities Exchange, Orascom Construction is well-positioned to expand its operations, secure high-value contracts, and strengthen its presence in the MENA region.

The move also sets a benchmark for other regional companies considering cross-border listings, demonstrating how strategic market transitions can unlock new opportunities and investor confidence. As Orascom Construction continues to deliver on its ambitious project portfolio, its presence on ADX will serve as a catalyst for sustained growth, innovation, and market leadership in the construction and engineering sector.

With a strong foundation, a clear strategy, and a growing market presence, Orascom Construction is poised to continue its upward trajectory, providing value to shareholders, clients, and the broader MENA infrastructure landscape. The ADX debut is not just a financial event; it is a strategic milestone that reinforces the company’s role as a key player in regional development and long-term economic growth.

Do follow UAE Stories on Instagram

Read Next – IMF Lebanon Reform Talks to Shape Economic Recovery