The Djibouti illegal seizure of Doraleh Terminal has been officially confirmed by the London Court of International Arbitration (LCIA). This ruling marks a decisive moment in one of the most high-profile disputes between a sovereign government and an international port operator. The case has implications not only for DP World and Djibouti but also for international trade, investment security, and the enforcement of contractual obligations in global infrastructure projects.

The dispute stems from the events of 2018 when the government of Djibouti seized control of the Doraleh Container Terminal (DCT), previously operated under a long-term concession agreement by DP World, a Dubai-based logistics and port management company. The LCIA ruling establishes that this action was unlawful, underlining the binding nature of international arbitration agreements and highlighting the importance of respecting contractual and legal commitments.

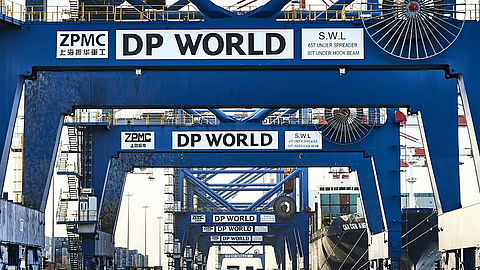

Background of the Doraleh Container Terminal

The Strategic Importance of Doraleh

The Doraleh Container Terminal is located on the Red Sea coast, a region that serves as a critical gateway for international shipping. Its strategic location enables it to handle cargo traffic between Africa, Europe, and Asia. For Djibouti, the terminal represents not only a major source of revenue but also an essential element of its positioning as a regional trade hub. For DP World, the terminal is a key investment in its global network of ports, contributing significantly to its operational and financial strategy.

The terminal itself is modern and technologically advanced, designed to handle millions of containers annually. Its capacity and efficiency have made it one of the most important logistical nodes in East Africa. It is also a symbol of international cooperation, showing how public-private partnerships can drive economic growth.

The 2006 Concession Agreement

The dispute originates from a 2006 agreement between DP World and the Djiboutian government, through its entity Port de Djibouti SA (PDSA). Under this 50-year concession agreement, DP World held a one-third stake in the terminal’s operations, while PDSA held the remaining two-thirds. The agreement granted DP World operational control, responsibilities for management, and rights to profit from its investment, while Djibouti retained oversight and a minority ownership interest.

The concession agreement was seen as a win-win arrangement. DP World brought in global expertise in port management and invested heavily in infrastructure upgrades, while Djibouti benefited from economic growth, increased port revenues, and international recognition as a logistics hub. This partnership lasted for over a decade and allowed Doraleh to grow into a world-class facility.

The 2018 Seizure

In February 2018, the government of Djibouti unilaterally terminated the concession agreement. It seized control of the terminal, citing concerns over national sovereignty and the desire to consolidate ownership of critical infrastructure. DP World staff were expelled, operations were abruptly halted, and the company’s authority over the terminal was revoked.

This seizure sent shockwaves through international trade and investment circles. Investors began to question the reliability of agreements in Djibouti and similar emerging markets. DP World immediately condemned the action as illegal and announced its intention to pursue international arbitration to defend its rights.

The seizure was controversial because it undermined the legal framework that protects foreign investments in Djibouti. It also raised questions about how sovereign governments balance national interests against international obligations and the rule of law.

The Legal Battle

Filing for Arbitration

In response to the seizure, DP World filed a claim with the London Court of International Arbitration (LCIA), the tribunal designated under the 2006 agreement for resolving disputes. The case focused on whether Djibouti had the legal right to terminate the concession and seize control of the terminal.

The arbitration proceedings examined the original concession terms, the circumstances of the seizure, and Djibouti’s legal justifications. DP World argued that the seizure violated the agreement, international law, and basic principles of fairness and contract enforcement.

The Tribunal’s Analysis

The LCIA tribunal carefully reviewed the arguments from both sides. The key points included the binding nature of the concession agreement, the role of PDSA, and the responsibilities of the Djiboutian government. The tribunal emphasized that sovereign interests do not provide a blanket excuse to violate contractual obligations or international law.

The analysis concluded that the unilateral termination of the agreement by Djibouti was unjustified and illegal. The tribunal found that the seizure directly breached the terms of the 2006 agreement and violated the rights of DP World as a legitimate investor and partner in the terminal.

The LCIA Ruling

Unlawful Seizure Confirmed

The LCIA formally ruled that the Djibouti illegal seizure of Doraleh Terminal was unlawful. This decision reinforces the authority of international arbitration in protecting investor rights and ensuring that sovereign states honor contractual obligations.

By confirming that the seizure violated the concession agreement, the tribunal sent a clear message: governments cannot disregard legally binding agreements without facing legal consequences. This ruling provides legal validation for DP World’s ongoing efforts to reclaim its rights and secure fair compensation.

Dismissal of Damages Against PDSA

While the ruling confirmed the illegal seizure, the tribunal dismissed DP World’s claim for damages against PDSA. The reasoning was that PDSA, as a government-linked entity, was not directly responsible for the government’s actions and thus not liable for damages.

Despite this, the ruling solidifies DP World’s claims against the government itself, leaving the company in a strong position to enforce its arbitration awards and pursue additional legal remedies.

Implications for DP World

Protecting Investments

The ruling provides reassurance to DP World and other international investors that arbitration agreements are enforceable and that illegal government actions can be challenged in global courts. The company now has the backing of a respected international tribunal in its claim for unpaid awards and restitution.

This decision also highlights the importance of legal frameworks in global business. Multinational companies rely on enforceable contracts and arbitration clauses to protect investments in foreign markets. The LCIA ruling reinforces this protection, ensuring that companies are not left vulnerable to arbitrary government actions.

Operational and Strategic Outlook

For DP World, the ruling does not immediately restore operational control over Doraleh but strengthens its legal standing. The company continues to explore avenues for compensation and enforcement while monitoring Djibouti’s response to the arbitration decision. The outcome may also influence DP World’s broader investment strategy, particularly in regions where legal frameworks are still developing.

Implications for Djibouti

Reputation and Investor Confidence

The ruling is a setback for Djibouti, challenging its narrative that the seizure was justified. It also raises concerns about the country’s willingness to adhere to international agreements and respect arbitration outcomes.

Investor confidence may be affected, as potential partners consider the risks of entering into long-term infrastructure deals in the country. Sovereign governments rely on trust and stability to attract foreign investment, and repeated violations of contractual obligations can undermine these objectives.

Economic Considerations

Doraleh Terminal remains a critical asset for Djibouti, generating revenue and supporting trade flows. The government’s approach to the dispute could influence the terminal’s operational efficiency and international partnerships. Compliance with the LCIA ruling may open the door for negotiations that preserve both the country’s interests and its attractiveness to global investors.

Broader Impact on International Trade and Arbitration

Upholding International Agreements

The LCIA ruling serves as a precedent for enforcing contracts between governments and international corporations. It emphasizes that arbitration is not merely a procedural formality but a binding mechanism for dispute resolution.

This decision reinforces the principle that contractual obligations are enforceable even against sovereign states, ensuring that agreements are honored and that parties are held accountable for unlawful actions.

Regional and Global Investment Implications

The ruling also has implications beyond Djibouti. Investors in emerging markets closely monitor such cases to assess risk levels. Governments that violate agreements may face reputational and financial consequences, affecting their ability to attract foreign capital.

By affirming DP World’s rights, the LCIA has sent a message to the global business community that legal protections exist and that international arbitration provides a reliable mechanism for resolving disputes.

Conclusion

The London Court of International Arbitration’s ruling on the Djibouti illegal seizure of Doraleh Terminal underscores the importance of respecting contractual obligations, adhering to international law, and honoring arbitration outcomes.

While the dismissal of damages against PDSA may seem like a partial relief for the government, the broader message is clear: sovereign actions cannot override legally binding agreements. The ruling strengthens investor confidence in international arbitration and serves as a reminder to all governments about the consequences of violating contracts.

As the dispute continues, the world watches Djibouti’s next moves closely. The decision has far-reaching consequences for international trade, foreign investment, and the global reputation of countries seeking to attract private capital. Upholding the principles of law, fairness, and contract enforcement remains crucial for sustainable economic growth and cooperation in the modern global economy.

With this ruling, DP World solidifies its position as a rightful operator of the Doraleh Terminal while reinforcing the credibility and authority of international arbitration. The case exemplifies how legal mechanisms can resolve disputes fairly, even when national interests and corporate investments collide.

Do follow UAE Stories on Instagram

Read Next – Emirates & flydubai Join Dubai Cashless Strategy Initiative