The Institute for Global Financial Competitiveness has officially been launched by New York University Abu Dhabi, marking a significant milestone in global finance research. This pioneering institute aims to provide rigorous, data driven insights into the performance of financial centers around the world. By leveraging advanced analytical tools and modern data science techniques, the institute seeks to help policymakers, investors, and business leaders understand and enhance the competitiveness of financial hubs.

The initiative is backed by billionaire investor Ray Dalio, whose expertise in global markets adds credibility and vision to the project. The institute will also launch the Financial Centres Competitiveness Index, a comprehensive framework designed to evaluate and rank international financial centers on a wide array of criteria, including governance, innovation, digital infrastructure, and sustainability.

The Importance of Financial Centers in a Global Economy

Financial centers play a critical role in shaping the global economy. Cities like New York, London, Hong Kong, and Singapore are more than just places for banking and trading. They act as hubs for innovation, investment, and economic growth. A strong financial center attracts capital, talent, and technological advancement, fueling economic development not just locally but globally.

As the world economy becomes increasingly interconnected, competition among financial centers is intensifying. Countries and cities are looking for innovative ways to attract investors, improve regulatory environments, and establish themselves as leaders in finance. The launch of the Institute for Global Financial Competitiveness responds to this growing need for reliable, data driven evaluation of financial hubs.

Strategic Location in Abu Dhabi

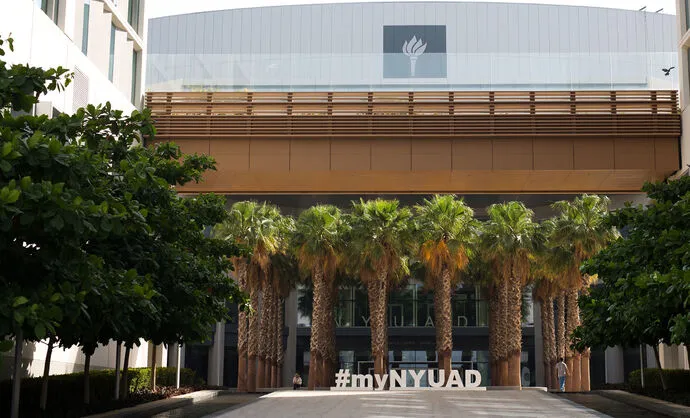

Choosing Abu Dhabi as the base for the institute is strategic. The city has emerged as a key player in the Middle East’s economic transformation, emphasizing diversification, technology, and sustainable growth. By situating the institute in Abu Dhabi, NYUAD positions it at the intersection of global financial markets, benefiting from its proximity to Europe, Asia, and Africa.

Abu Dhabi’s growing influence, world class infrastructure, and forward thinking government policies create an environment conducive to cutting edge research. The city’s commitment to establishing itself as a knowledge driven economy aligns perfectly with the institute’s mission.

Vision and Mission of the Institute

The Institute for Global Financial Competitiveness aims to become a global leader in evaluating financial centers and promoting financial excellence. Its primary objectives include:

- Assessing financial centers objectively using comprehensive criteria to rank financial hubs globally

- Promoting best practices by offering insights into governance, innovation, and economic sustainability

- Informing policymakers by providing governments and institutions with actionable recommendations to enhance their competitiveness

- Encouraging innovation by identifying trends and opportunities in financial technology and sustainable finance

By focusing on these objectives, the institute aspires to foster a more transparent, competitive, and resilient global financial ecosystem.

Role of Ray Dalio in Supporting the Initiative

Ray Dalio, founder of Bridgewater Associates, is renowned for his understanding of global financial systems. His support of the institute not only provides financial backing but also reinforces its credibility in the eyes of international stakeholders. Dalio’s expertise and global perspective are invaluable in shaping research methodologies and guiding strategic priorities.

With Dalio’s involvement, the institute is expected to attract top tier researchers, financial experts, and policy advisors, creating a hub of intellectual excellence dedicated to analyzing global financial centers.

Financial Centres Competitiveness Index

At the heart of the institute’s work is the Financial Centres Competitiveness Index. This index is designed to provide a multi dimensional evaluation of financial centers, offering a clear picture of their strengths and weaknesses.

The index assesses each center based on several key criteria:

- Innovation by evaluating technological adoption, fintech development, and innovative practices

- Digital infrastructure including digital banking, cybersecurity measures, and the adoption of AI in financial operations

- Governance and regulations by analyzing the quality of legal frameworks, transparency, and regulatory efficiency

- Sustainability through green finance initiatives, ESG practices, and social responsibility programs

- Talent and education by assessing workforce skill levels, access to education, and professional development opportunities

- Connectivity by evaluating the integration of the center within global markets and its ability to attract cross border investments

By combining these factors, the index provides an accurate and actionable measure of a financial center’s global standing.

Anticipated Benefits for Global Financial Hubs

The launch of the Institute for Global Financial Competitiveness is expected to bring several benefits to global financial centers:

- Data driven insights providing governments, investors, and institutions with reliable rankings and actionable recommendations

- Encouraging healthy competition, inspiring financial hubs to adopt best practices and improve infrastructure, governance, and innovation

- Enhancing investor confidence by offering transparent evaluations that can help attract foreign investment

- Promoting collaboration through partnerships between governments, financial institutions, and research bodies

- Driving policy reforms by informing policymakers about areas that require attention, helping to strengthen financial regulations

Overall, the institute aims to elevate the global standard for financial centers, ensuring they are more resilient, innovative, and competitive in a rapidly changing economic landscape.

Focus on Education and Research

Education and research are central to the institute’s vision. NYU Abu Dhabi will leverage its academic expertise to conduct rigorous studies, host seminars, and publish papers that examine trends in global finance. Students and faculty will have the opportunity to engage in hands on research, working alongside leading financial experts.

By combining academic rigor with practical applications, the institute seeks to produce actionable insights that benefit both the financial industry and the wider global economy. Training the next generation of financial leaders is a key priority, ensuring that emerging talent is equipped with the knowledge and skills needed to navigate complex markets.

Engaging the Global Community

The institute is not limited to Abu Dhabi. It aims to engage with a global network of financial institutions, regulators, and policymakers. Conferences, workshops, and collaborative projects will bring together experts from around the world to discuss challenges and opportunities facing financial centers.

One of the most anticipated events is the presentation of the inaugural index during the Global Markets Summit at Abu Dhabi Finance Week. This platform will allow the institute to share its findings with an international audience, stimulating discussion and encouraging the adoption of innovative practices across financial hubs.

Sustainability and the Future of Finance

Sustainability is a key pillar of the institute’s research agenda. Financial centers are increasingly expected to support environmentally and socially responsible growth. By integrating sustainability metrics into the index, the institute highlights the importance of green finance, ESG initiatives, and sustainable investment practices.

Promoting sustainability not only enhances global reputation but also attracts investors who prioritize responsible finance. By providing insights on how financial centers can become more sustainable, the institute encourages a shift toward a more inclusive and environmentally conscious global economy.

Expected Long Term Impact

The long term impact of the Institute for Global Financial Competitiveness is expected to be profound. As financial centers adopt the insights generated by the index, we may witness:

- Improved financial governance and regulation

- Increased adoption of innovative financial technologies

- Stronger international collaboration and knowledge sharing

- More transparent and accountable financial markets

- Enhanced resilience against global economic challenges

Ultimately, the institute’s work will contribute to a more competitive and robust global financial ecosystem, benefiting economies, investors, and communities worldwide.

Conclusion

The launch of the Institute for Global Financial Competitiveness by NYU Abu Dhabi represents a forward thinking approach to understanding and improving global financial centers. By combining academic research, advanced data science, and practical insights, the institute is set to become a world leading authority on financial competitiveness.

Through initiatives such as the Financial Centres Competitiveness Index, the institute will provide valuable guidance to policymakers, investors, and financial institutions. With Abu Dhabi as its base and Ray Dalio’s backing, the institute is well positioned to make a lasting impact on global finance.

As financial centers around the world face increasing competition and rapid technological change, the institute’s insights will be invaluable in guiding their development, fostering innovation, and promoting sustainable, resilient, and globally integrated financial systems.

Do follow UAE Stories on Instagram

Read Next – ERA Investigation Unit UAE: Enhancing Integrity in Horse Racing