Huru, a homegrown fintech platform licensed by the Central Bank of the UAE, has introduced its latest feature called Quick Cash. This new microfinance solution is designed to support individuals who often struggle to access mainstream banking or credit services. Launched in partnership with Mawarid Finance, Quick Cash aims to offer fast, regulated, and transparent financial support for unbanked and underbanked communities across the UAE.

As the country strengthens its commitment to financial inclusion and expands the framework for personal lending, Quick Cash arrives at a crucial moment. It provides a safe and accessible option for workers who need immediate financial support but lack traditional credit histories. By combining technology, ethical financing, and user-focused design, Huru is shaping a more inclusive and trustworthy financial landscape in the UAE.

Huru’s Commitment to Better Financial Access

Since its inception, Huru has focused on building an ecosystem that helps underserved communities manage their money more effectively. The platform offers users a range of essential financial tools such as zero-balance IBAN accounts, free digital and physical Visa ATM cards, in-app remittances, bill payments, and saving features. These tools make it easier for users to receive salaries, send money home, pay bills on time, and save consistently.

Quick Cash is the latest addition to this ecosystem. It supports Huru’s mission to deliver meaningful and affordable financial services to individuals who often rely on informal borrowing. By providing a regulated and reliable microfinance option, Huru is helping users solve urgent financial needs while promoting long-term financial wellbeing.

Why Quick Cash Is Important for the UAE

The UAE has recently updated its regulatory guidelines to expand eligibility for personal lending. This shift encourages responsible and transparent financial products, especially for communities that remain outside the traditional banking system. In this environment, Quick Cash becomes a valuable tool that aligns with national goals of boosting financial inclusion.

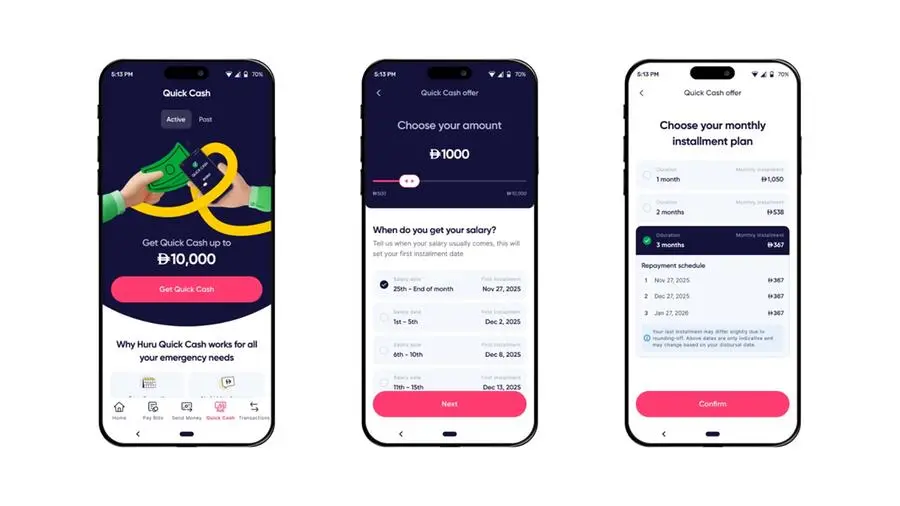

Through Quick Cash, users can access up to AED 10,000 instantly. The process is designed to be simple, fast, and user-friendly. Once approved, funds are disbursed immediately into the user’s Huru account. Repayments happen through monthly installments that are automatically deducted from their salary accounts. This ensures responsible borrowing without causing overwhelming financial pressure.

Designed for Real-Life Needs of Workers

A large segment of the UAE population relies on low to middle-income jobs. Many of these individuals face difficulties accessing credit due to limited documentation or lack of historical banking activity. As a result, they often turn to unregulated lenders or request frequent salary advances from employers, which can lead to stress and financial instability.

Quick Cash directly addresses these challenges by offering:

Fast Access to Small Loans

Users can receive microfinance within minutes, eliminating long waiting periods or complicated approval processes.

Clear and Transparent Costs

The feature charges low and straightforward mark-up fees so users fully understand what they will repay.

Automatic Monthly Deductions

Repayments are directly deducted from the salary account, helping users avoid missed payments or financial mismanagement.

No Employer Involvement

Users no longer need to request salary advances, reducing pressure on both employees and employers.

Quick Cash creates a sense of financial security by giving users a reliable option for emergency support, essential expenses, and short-term financial gaps.

A Data-Driven and Responsible Lending Model

Quick Cash is powered by Huru’s advanced eligibility and underwriting system, which uses multiple data points to make fair and accurate lending decisions. The system evaluates factors such as salary inflows, spending behavior, self-declared information, and alternative financial indicators. These insights are fed into Huru’s machine-learning engine, which ensures lending decisions are responsible and inclusive.

This technology-driven approach allows Huru to support individuals who may not have traditional credit scores or documented financial histories. Instead of purely relying on conventional banking records, the system assesses real-life financial behavior. This creates a more open and fair lending environment, especially for new residents or low-income workers.

Sharia-Compliant Lending Through Mawarid Finance

The development of Quick Cash is made possible through a strategic partnership with Mawarid Finance, a leading provider of Sharia-compliant financial services in the UAE. Mawarid Finance ensures that the solution meets ethical and regulatory standards while remaining accessible and user-friendly.

By combining Huru’s technology with Mawarid’s strong foundation in responsible finance, Quick Cash becomes a trustworthy option for users seeking microfinance that aligns with personal values and UAE financial regulations. The partnership reflects a shared vision of creating long-term, stable, and inclusive financial solutions within the region.

Supporting Employers Through Reduced Salary Advance Requests

Frequent salary advance requests can place significant administrative pressure on employers. These requests also indicate financial stress among employees, which can negatively impact performance and morale. Quick Cash solves this challenge by offering a structured microfinance option that employees can access independently.

For employers, this means:

• Fewer salary advance requests

• Reduced workload for HR and payroll teams

• Improved employee financial stability

• Higher confidence, morale, and retention

When employees have access to responsible financial support, they feel more secure and focused. This contributes to healthier workplace environments and better organizational stability.

Strengthening the UAE’s Financial Ecosystem

The launch of Quick Cash highlights the commitment of both Huru and Mawarid Finance to empower individuals who contribute significantly to the UAE’s growth. By offering accessible financing options through digital platforms, the UAE is moving closer to a future where financial services are inclusive and equal for everyone.

Huru’s expanding ecosystem supports not only individual users but also the broader national agenda of building a strong, fair, and advanced financial system. Through innovation and ethical financial practices, Huru continues to bridge the gap between traditional banking and the evolving needs of diverse communities.

About Huru

Huru is a UAE-born fintech company licensed by the Central Bank of the UAE. Established in 2022, the platform focuses on delivering financial access and management tools to unbanked and underbanked individuals. Its core features include zero-balance IBAN accounts, Visa ATM cards, remittance services, bill payments, and saving tools. With the introduction of credit products like Quick Cash, Huru continues to expand its impact on financial inclusion across the country.

About Mawarid Finance

Mawarid Finance is regulated by the Central Bank of the UAE and specializes in Sharia-compliant financial solutions. The company combines responsible finance with digital innovation, offering accessible products for individuals, SMEs, and fintech platforms. Mawarid Finance plays a key role in enabling modern financial experiences while upholding ethical and transparent standards.

Do follow UAE Stories on Instagram

Read Next – Chawla Shines as Ajman Titans Defeat Vista Riders by 34 Runs