Unlocking the Secrets: How to Calculate ROI on UAE Rental Properties

Investing in UAE rental properties can be an exciting venture, especially considering the booming real estate market. However, understanding how to calculate ROI on UAE rental properties is crucial for ensuring that your investment yields the returns you expect. In this guide, we will break down the process into manageable steps, helping you make informed decisions and maximize your investment potential.

Understanding ROI: The Basics Explained

Return on Investment (ROI) is a financial metric used to evaluate the profitability of an investment. For rental properties, ROI helps investors understand how effectively their money is working. In the context of UAE rental properties, calculating ROI allows you to assess the performance of your investment against the costs involved.

To calculate ROI, you need to consider both the income generated from your rental property and the expenses associated with owning it. This straightforward formula can sum it up:

ROI = (Net Income / Total Investment) x 100

Let’s explore this further to grasp the intricacies of calculating ROI on UAE rental properties.

Step-by-Step Guide: Calculating ROI on UAE Rental Properties

1. Determine Your Total Investment: What’s at Stake?

Before diving into the calculations, you must assess your total investment in the property. This includes:

- Purchase price

- Closing costs

- Renovation and repair expenses

- Ongoing costs such as property management fees, insurance, and taxes

By accumulating these figures, you’ll have a clearer picture of your total investment.

2. Calculate Your Annual Rental Income: What’s Coming In?

Next, it’s essential to identify how much income you expect to generate from your rental property. To do this:

- Determine the monthly rental rate you plan to charge

- Multiply by 12 to get the annual rental income

Consider the potential for vacancies. It’s wise to factor in an estimated vacancy rate, which can help you arrive at a more realistic figure for your annual rental income.

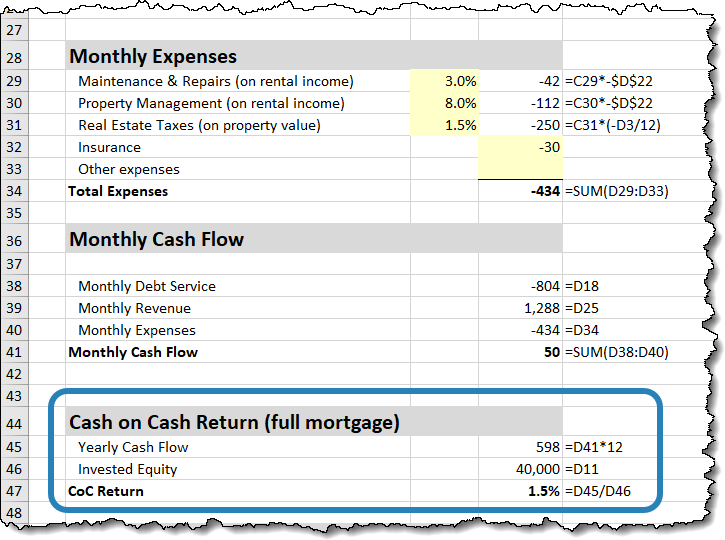

3. Account for Operating Expenses: What’s Going Out?

Every property comes with its share of operating expenses. To accurately calculate ROI on UAE rental properties, you need to consider:

- Property management fees

- Maintenance and repair costs

- Utilities (if applicable)

- Property taxes and insurance

Subtract these expenses from your annual rental income to derive your net income.

4. Plugging the Numbers into the ROI Formula: The Moment of Truth

Now that you have your net income and total investment, it’s time to plug the numbers into the ROI formula mentioned earlier.

For example, if your total investment is AED 1,000,000 and your net income is AED 100,000, the calculation would look like this:

ROI = (100,000 / 1,000,000) x 100 = 10%

This means your investment yields a 10% return, a solid figure in the realm of real estate.

Maximizing Your ROI: Tips and Tricks to Boost Your Returns

1. Choose the Right Location: The Power of Location

In the UAE, certain areas are more desirable than others. Research emerging neighborhoods and upcoming developments that may increase property value over time. A prime location can significantly boost your rental income and, consequently, your ROI.

2. Improve Property Appeal: Small Changes, Big Impact

Consider making strategic upgrades to your rental property. Simple enhancements like fresh paint, modern appliances, or landscaping can attract higher-paying tenants and decrease vacancy rates. This can lead to increased rental income over time.

3. Understand the Market: Knowledge is Power

Stay informed about market trends and rental rates in your area. Understanding the local market will help you set competitive rental prices and anticipate when to adjust them.

4. Optimize Tax Benefits: Financial Savvy

Investigate any tax deductions available for rental property owners in the UAE. Expenses like management fees, maintenance, and depreciation can often be deducted, ultimately improving your net income and ROI.

Real-Life Example: Success Stories in UAE Rental Investments

To illustrate how to calculate ROI on UAE rental properties, let’s look at an example.

Imagine you purchased a property in Dubai for AED 1,200,000. After renovations and management fees, your total investment comes to AED 1,350,000. You charge AED 10,000 per month in rent, leading to an annual income of AED 120,000. After considering AED 20,000 in annual expenses, your net income is AED 100,000.

Using the ROI formula:

ROI = (100,000 / 1,350,000) x 100 = 7.41%

While this return may seem modest, consider the potential for property appreciation in the UAE’s dynamic market, which could yield significant long-term gains.

The Importance of Regularly Reassessing ROI: Stay Ahead of the Game

As the real estate market fluctuates, it’s vital to regularly reassess your ROI. Changes in rental rates, property values, and your own financial situation can impact your overall return. Regular assessments allow you to make timely adjustments to your investment strategy, ensuring that your rental property remains profitable.

Final Thoughts: Your Path to Successful Investments

Knowing how to calculate ROI on UAE rental properties is essential for any investor aiming to thrive in this competitive market. By understanding the formula, evaluating your investment, and making informed decisions, you’ll be well on your way to maximizing your returns.

As you embark on this investment journey, remember that patience and continuous learning are key. Real estate can be a rewarding venture if approached wisely.

Written by

Do follow UAE Stories on Instagram:

Link: https://www.instagram.com/uaestoriesofficial