Gold rate in the UAE is a topic of interest for investors, jewelers, and consumers alike. Known for its thriving gold market, Dubai, often referred to as the “City of Gold,” plays a pivotal role in the global gold trade. For those looking to invest or simply stay informed, understanding the gold rate trends through graphical representation offers valuable insights.

In this article, we explore the significance of tracking gold rate graphs in the UAE, how these trends are influenced, and what they mean for different stakeholders.

Why Gold Rates Matter in the UAE

Gold holds a special place in the UAE’s economy and culture. Whether for investment, trade, or personal adornment, gold is a highly sought-after commodity. Dubai, in particular, is famous for its Gold Souk, which attracts millions of buyers every year.

Understanding the daily and long-term trends in gold rates helps:

- Investors: Make informed decisions about buying or selling gold.

- Consumers: Plan purchases, especially for weddings or gifts.

- Businesses: Jewelers and traders strategize pricing and inventory.

Key Factors Influencing Gold Rates in the UAE

Gold prices in the UAE are influenced by several local and global factors. Some of the most significant include:

- Global Market Trends: Gold is traded internationally, and global demand and supply directly impact its price.

- US Dollar Strength: Since gold is priced in US dollars, fluctuations in the dollar’s value influence gold rates. A weaker dollar often results in higher gold prices.

- Crude Oil Prices: As the UAE is an oil-producing nation, the performance of the oil market indirectly affects the gold market.

- Geopolitical Events: Economic or political instability increases gold’s appeal as a safe-haven asset, driving up its price.

- Local Demand: During festive seasons, weddings, or special occasions, increased demand can cause temporary price hikes.

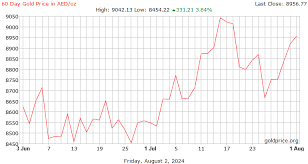

Reading a Gold Rate Graph

Gold rate graphs are a visual representation of price movements over a specific period. They help investors and consumers spot trends and make predictions. Here’s how to interpret the key elements of a gold rate graph:

- X-Axis (Time): Represents the time frame, such as days, months, or years.

- Y-Axis (Price): Shows the gold price, often in AED per gram.

- Trend Line: Indicates the general direction of gold prices over time.

- Peaks and Troughs: Highlight periods of price highs and lows.

- Moving Averages: Used to smooth out short-term fluctuations and show longer-term trends.

Gold Rate Trends in the UAE

Daily Trends

The daily gold rate graph is useful for tracking short-term price changes. Factors like currency exchange rates and global market openings can cause slight fluctuations. Jewelers and day traders often rely on this graph for immediate decision-making.

Monthly Trends

Monthly gold rate graphs provide a broader perspective, helping identify seasonal patterns. For example, gold prices may rise during wedding seasons or major festivals like Diwali.

Yearly Trends

Yearly graphs are essential for long-term investors. These graphs showcase how gold has performed over years, reflecting its value as a stable and appreciating asset. In recent years, the price of gold has shown a steady upward trajectory due to economic uncertainties and inflation concerns.

Recent Gold Rate Trends in the UAE

Over the past few years, the gold rate in the UAE has witnessed significant changes. Key observations include:

- Impact of COVID-19 (2020-2021): During the pandemic, gold prices surged as investors sought safe-haven assets.

- Post-Pandemic Recovery (2022-2023): Prices stabilized but remained elevated due to inflation concerns and geopolitical tensions.

- Current Trends (2024-2025): Fluctuations continue, with gold prices influenced by interest rate changes and global economic conditions.

Gold Rate Graphs for Different Stakeholders

For Investors

Investors use gold rate graphs to time their purchases and sales. Identifying trends like breakouts or corrections helps them maximize returns. For instance, a consistent upward trend may signal a good time to hold onto investments, while a downward trend could indicate a selling opportunity.

For Jewelers

Jewelers rely on graphs to price their products competitively. They also use trends to predict periods of high demand and plan inventory accordingly. For example, a spike in prices might encourage them to stock up during lower-rate periods.

For Consumers

Consumers planning significant purchases, such as wedding jewelry, benefit from studying gold rate graphs to choose the most economical times. Observing a dip in prices could mean significant savings on large purchases.

Tools for Accessing Gold Rate Graphs

Staying updated on gold rate trends has become easier with the availability of various tools and platforms:

- Mobile Applications: Apps dedicated to gold rates in the UAE provide real-time graphs and price alerts.

- Bank Websites: Many banks in the UAE display gold price trends for their customers.

- Market Analytics Platforms: These offer detailed insights, including historical data and predictive models.

- Local Jewelers: Many jewelers update gold rate graphs on their websites to help customers make informed decisions.

Tips for Analyzing Gold Rate Graphs

- Understand Market Conditions: Stay informed about global economic events that may influence gold prices.

- Compare Time Frames: Analyze daily, monthly, and yearly graphs for a comprehensive understanding.

- Identify Trends: Look for consistent upward or downward patterns to predict future movements.

- Use Indicators: Tools like moving averages or relative strength index (RSI) can help refine your analysis.

- Stay Patient: Gold is often a long-term investment, so avoid making hasty decisions based on short-term fluctuations.

The Future of Gold Rates in the UAE

While gold prices are inherently volatile, they remain a reliable investment for those seeking stability during uncertain times. The UAE’s position as a global hub for gold trade ensures that gold will continue to be a crucial commodity in the region.

Experts predict that as inflation persists and geopolitical tensions linger, gold prices will maintain their upward trajectory. For investors and consumers in the UAE, keeping an eye on gold rate graphs and understanding the factors driving these trends will be key to making the most of this precious metal.

Conclusion

Gold rate graphs in the UAE provide a wealth of information for anyone involved in the gold market. By studying these graphs and staying informed about market trends, investors, jewelers, and consumers can make informed decisions that align with their goals.

Whether you’re buying gold as an investment, for personal use, or as a gift, understanding its price movements through graphical analysis ensures that you’re making the most out of this timeless asset. In a city like Dubai, where gold holds both cultural and economic significance, staying updated on gold rates is not just practical but essential.

Do follow Uae stories for more Updates