In a world where economies have been on a tightrope walk between inflation and growth, a welcome sense of calm has emerged this week. The United States, Taiwan, and the United Arab Emirates made a collective decision to keep their interest rates unchanged — a move that has sent a ripple of relief through global financial markets.

This strategic pause signals a moment of stability in the middle of what has been an uncertain financial year for many economies battling inflationary pressures, global conflicts, and volatile markets.

Let’s unpack what this means for businesses, consumers, and the wider world economy.

A Decision That Eased Global Tensions

For months, the world has been watching closely as central banks worldwide made aggressive moves to combat inflation. Rapid interest rate hikes in the past year have left businesses cautious, consumers anxious, and investors jittery.

The recent decision by the US Federal Reserve, Taiwan’s Central Bank, and the UAE Central Bank to hold interest rates steady has been seen as a calculated move — providing breathing space for markets and economies still grappling with post-pandemic recovery challenges.

It’s not just about numbers on paper. These interest rates directly affect home loans, business borrowing costs, investment returns, and even job creation. And for once, this steady pause has felt like a reassuring handshake extended to both businesses and households alike.

Why This Pause Matters Now

Timing is everything in finance. After a string of successive rate hikes globally, inflation in several major economies has started to show signs of cooling. However, fears of a potential recession have also been growing louder.

In this climate, central banks often face a delicate balancing act: tighten too much and risk choking growth; ease up too soon and inflation could surge again.

By choosing to hold rates steady, these three nations are essentially signalling confidence in the resilience of their economies while still keeping inflation in check. This also gives businesses room to regroup and make future plans without the looming threat of rising borrowing costs.

What It Means for the Average Person

Behind every financial policy decision lies a human story. While the numbers and percentages might seem abstract, their impact touches everyday lives in ways both big and small.

For homeowners in these countries, it means mortgage rates are likely to remain stable for now. For small businesses, it translates to a reprieve from increasing loan repayments. And for jobseekers, it might mean more cautious but sustained hiring as businesses find some predictability in operating costs.

In the broader sense, a pause like this also reassures consumers about the overall direction of the economy. It helps steady nerves in global markets, which in turn influences everything from stock prices to currency values — all of which ultimately impact people’s financial well-being.

How Markets Reacted

Financial markets are known for reacting swiftly to any policy signals. This time, the decision to keep interest rates unchanged brought a visible sense of relief.

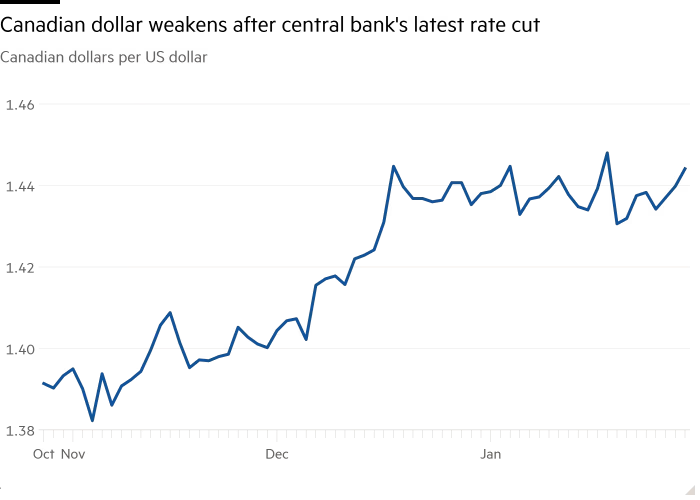

Stock indices across major financial hubs saw modest gains, while currencies stabilised against the dollar. Investors, who had been bracing for yet another round of tightening, responded with cautious optimism.

Bond markets, often sensitive to interest rate movements, also showed positive signs. Yields remained steady, suggesting confidence in the central banks’ strategy of prioritising stability over sudden, sharp changes.

The Broader Global Ripple Effect

Decisions made in the financial hubs of the US, Taiwan, and the UAE don’t exist in isolation. Their economic choices ripple outwards, influencing trade partners, investment patterns, and regional policies.

For countries in the Middle East, Africa, and Southeast Asia, the UAE’s decision is particularly impactful. As a major trade and financial hub, stability in UAE’s monetary policy can steady regional markets and investment flows.

Similarly, the US Federal Reserve’s hold on rates is a move that typically affects global commodity prices, emerging market currencies, and cross-border investment trends. Taiwan’s decision, though regionally focused, also matters in the broader Asian economic ecosystem, especially given its significant role in global tech and semiconductor supply chains.

Challenges Still Ahead

While this pause has been widely welcomed, it doesn’t mean the road ahead is entirely smooth. Inflationary pressures, although easing, haven’t disappeared entirely. Geopolitical tensions in parts of Europe and the Middle East continue to pose risks, while fluctuating energy prices keep financial planners on their toes.

Central banks have made it clear that while rates are on hold for now, they remain ready to act should inflation spike again. It’s a cautious optimism — a recognition of progress made, but also an awareness of potential threats lurking around the corner.

A Strategic Breather for Businesses

For businesses, particularly small and medium enterprises (SMEs), this moment offers a much-needed breather.

Over the past year, rising borrowing costs forced many businesses to scale back expansion plans, freeze hiring, or increase prices. With interest rates now steady, companies can revisit shelved plans, renegotiate loan terms, and invest in growth initiatives without the immediate pressure of escalating costs.

This is especially vital for sectors like retail, hospitality, real estate, and manufacturing, which rely heavily on credit for operations and expansion.

Consumer Confidence Gets a Lift

At the heart of every economy is the consumer. When people feel optimistic about the economy, they spend more — on homes, cars, travel, education, and entertainment. And when they spend, businesses thrive, jobs are created, and economies grow.

The news of interest rates holding steady may not directly put extra money in people’s pockets, but it does boost consumer sentiment. It signals a period of stability where financial plans feel a little safer, and long-term commitments — like buying a home or starting a business — seem less daunting.

UAE’s Calculated Approach Pays Off

The UAE’s decision to keep rates unchanged mirrors its broader economic strategy — one that balances growth ambitions with financial prudence.

Over the years, the country has made impressive strides in diversifying its economy, reducing dependence on oil, and positioning itself as a global hub for finance, tourism, and technology.

By maintaining stable interest rates, the UAE reinforces its commitment to providing a predictable, investor-friendly climate that encourages both domestic and international business activity.

US and Taiwan’s Steady Hands

For the United States, this pause is part of a carefully crafted narrative. After months of aggressive tightening, signs of cooling inflation and resilient job markets gave the Federal Reserve confidence to take a step back — at least for now.

Taiwan, on the other hand, faces a unique set of challenges as a tech-driven economy heavily influenced by global trade dynamics. Keeping rates steady allows it to remain competitive while managing inflation without stifling its growth prospects.

Final Thoughts: A Welcome Sign of Stability

In today’s world of economic unpredictability, a coordinated pause on interest rate hikes is more than just a policy decision — it’s a message of stability, resilience, and cautious optimism.

It tells businesses that it’s safe to breathe again. It tells consumers that the storm may be passing. And it tells the world that while challenges remain, there’s a clear path forward — one where growth and stability can coexist.

For economies big and small, this decision couldn’t have come at a better time.

Do follow UAE Stories on Instagram

FICCI to Organise B2B Meetings on Expanding Business Globally Through UAE