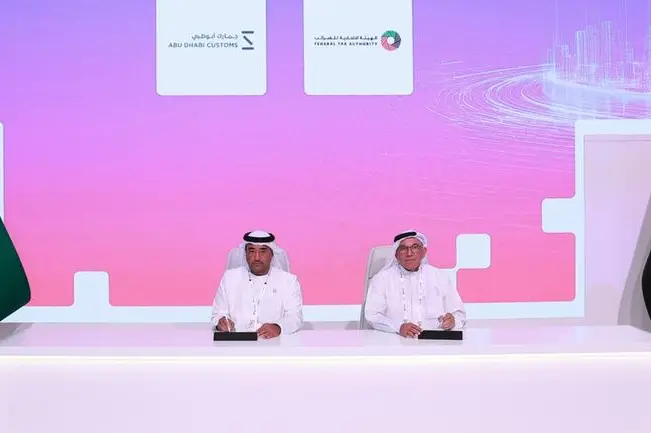

The Federal Tax Authority (FTA) and Abu Dhabi Customs have taken a major step forward by enhancing cooperation through advanced electronic linking channels. This collaboration aims to establish unified procedures between the two entities, simplifying processes for taxpayers and traders while improving data accuracy and operational efficiency.

This initiative aligns with the UAE’s broader digital transformation strategy, which seeks to create a fully integrated government ecosystem. By leveraging technology, both the FTA and Abu Dhabi Customs aim to make customs and tax operations more transparent, efficient, and customer-friendly.

Building a Digital Bridge Between Tax and Customs Systems

The electronic linking channels serve as the foundation for seamless data exchange between the FTA and Abu Dhabi Customs. This integration will enable both entities to share information securely and in real-time, reducing the need for manual data entry and paperwork.

The new system will help detect discrepancies faster, prevent duplication, and ensure that both tax and customs authorities operate with consistent data. For businesses, this means faster clearance times, simplified reporting, and fewer administrative burdens when dealing with imports and exports.

By creating a digital bridge between tax and customs systems, the UAE is setting new benchmarks for inter-agency collaboration in the region.

Enhancing Efficiency and Transparency for Businesses

One of the key goals of this initiative is to support the private sector by making compliance simpler and faster. Businesses involved in trade and logistics will benefit from automated verification processes, improved tracking of goods, and reduced turnaround times at ports and borders.

Transparency is another major advantage. The integration ensures that all transactions are digitally recorded and traceable, minimizing the chances of human error or fraud. This builds greater trust between the business community and government institutions.

Additionally, electronic linking will enhance the accuracy of tax declarations, ensuring that data shared between customs and tax systems matches perfectly. This will also help the FTA and Abu Dhabi Customs detect and resolve discrepancies proactively.

Supporting the UAE’s Digital Economy Vision

The collaboration aligns closely with the UAE’s vision for a digital and knowledge-based economy. By transforming government operations into smart, data-driven systems, the nation continues to lead the way in digital governance across the Middle East.

The FTA and Abu Dhabi Customs’ cooperation reflects the UAE leadership’s commitment to innovation, efficiency, and sustainability in all government services. This partnership supports the broader strategy of enhancing public sector integration to improve ease of doing business and attract more global trade.

Through digital transformation, the UAE is not only simplifying compliance but also creating a foundation for predictive data analysis, risk management, and performance measurement.

The Benefits of Electronic Linking Channels

The electronic linking channels developed between the FTA and Abu Dhabi Customs offer multiple advantages:

- Faster Processes: Automated data sharing cuts down the time needed for approvals and verification.

- Improved Accuracy: Real-time data synchronization minimizes human errors and ensures consistency across systems.

- Enhanced Compliance: Businesses will find it easier to comply with both tax and customs regulations simultaneously.

- Stronger Security: Advanced encryption and secure data protocols protect sensitive trade and tax information.

- Environmental Impact: Reduced paperwork aligns with the UAE’s sustainability goals by minimizing physical document use.

These benefits reflect the UAE’s commitment to building a future-ready government that combines innovation with operational excellence.

Joint Teams and Technical Cooperation

To ensure smooth implementation, both authorities have established joint working teams. These teams are responsible for overseeing the technical aspects of integration, defining shared data standards, and testing the electronic linking channels before full deployment.

The collaboration also includes regular workshops and technical meetings where both entities exchange expertise, share feedback, and review progress. This continuous dialogue ensures that the system remains flexible, secure, and responsive to business needs.

Such technical cooperation is not limited to system integration; it also extends to developing unified operational procedures and aligning regulations for smoother coordination.

A Step Toward Unified Government Services

The FTA and Abu Dhabi Customs’ partnership is part of a broader vision to unify government services and enhance customer experience. By eliminating silos between departments, the UAE is moving toward a model where businesses can access multiple services through a single digital platform.

This unified approach saves time and resources for both the government and the private sector. It enables faster decision-making, reduces bureaucratic barriers, and allows businesses to focus on growth rather than compliance hurdles.

The electronic linkage project symbolizes a shift from traditional manual procedures to a smart governance framework where all relevant entities work together seamlessly.

Strengthening the UAE’s Trade Competitiveness

The UAE’s position as a global trade hub depends heavily on the efficiency of its customs and taxation systems. The enhanced coordination between the FTA and Abu Dhabi Customs ensures smoother trade flows, fewer delays, and greater transparency in import-export operations.

As a result, this initiative strengthens the UAE’s global competitiveness by providing businesses with an environment that supports rapid logistics, streamlined taxation, and high levels of regulatory certainty.

Foreign investors and multinational corporations view this as a positive sign of the UAE’s commitment to maintaining world-class infrastructure and digital governance.

Fostering Trust and Collaboration Between Stakeholders

One of the most human aspects of this initiative is the emphasis on trust and collaboration. Both entities understand that the success of any digital transformation depends not only on technology but also on teamwork and shared purpose.

The partnership between the FTA and Abu Dhabi Customs demonstrates a strong institutional alignment based on transparency, responsibility, and public service excellence. By working together, they aim to provide taxpayers, importers, and exporters with an experience that is efficient, reliable, and fair.

This human-centered approach to digital transformation ensures that technology serves the people — not the other way around.

Looking Ahead: A Model for Future Integration

The success of this collaboration could serve as a model for other government departments in the UAE and across the GCC region. The idea of interconnected systems that exchange data instantly can be applied to various sectors such as finance, logistics, and public safety.

Future plans may include expanding the scope of integration to include other emirates’ customs authorities, banking systems, and international trade partners. As the UAE continues to digitize its economy, such integrations will become the backbone of governance and economic competitiveness.

The Federal Tax Authority and Abu Dhabi Customs are setting the stage for a more connected, transparent, and efficient government ecosystem — one that reflects the UAE’s leadership in innovation and forward-thinking governance.

Conclusion: Building the Future of Smart Governance in the UAE

The enhanced cooperation between the Federal Tax Authority and Abu Dhabi Customs marks a new era of collaboration in the UAE’s digital governance journey. Through electronic linking channels, the two entities have demonstrated how technology can transform public administration, making it more efficient, transparent, and user-centric.

This initiative not only benefits businesses and taxpayers but also strengthens the UAE’s reputation as a leader in digital transformation and government innovation. As both authorities continue to refine and expand their collaboration, the future looks promising for a smarter, more connected UAE.

Do follow UAE Stories on Instagram

Read Next – Forbes Middle East Kicks Off 3rd Annual Sustainability Leaders Summit