Dubai top FinTech hub is no longer just a dream. According to the latest Global Financial Centres Index (GFCI), Dubai has joined the world’s top four FinTech hubs. This milestone marks a turning point in the city’s journey toward becoming a global leader in finance, technology, and innovation.

This achievement is more than just a number on a ranking list. It shows how Dubai has built a strong ecosystem for financial services, created a welcoming environment for innovation, and attracted investors and entrepreneurs from around the world. In this article, we look at how Dubai reached this level, what it means for the future, and the challenges it must face to maintain its place.

Understanding the Global Financial Centres Index

The Global Financial Centres Index, or GFCI, is an international ranking that measures the competitiveness of major financial hubs. It looks at multiple factors, such as business environment, human capital, infrastructure, and sector-specific strengths. One of its important categories is FinTech, which has grown in importance as digital finance reshapes the global economy.

Dubai’s rise in the latest GFCI rankings is a signal to the world. It shows that the city is not only competing with traditional financial giants like London, New York, and Singapore but also becoming a key global player in the future of finance.

How Dubai Became a Top FinTech Hub

Strategic Vision and Government Support

Dubai’s leadership has long understood the importance of economic diversification. The Dubai Economic Agenda D33 aims to make the city one of the top three global destinations for living, working, and investing by 2033. FinTech plays a central role in that plan.

The government has introduced forward-thinking policies and incentives to attract startups, global firms, and investors. This strong support has given Dubai a clear advantage compared to other cities where regulation can often slow down innovation.

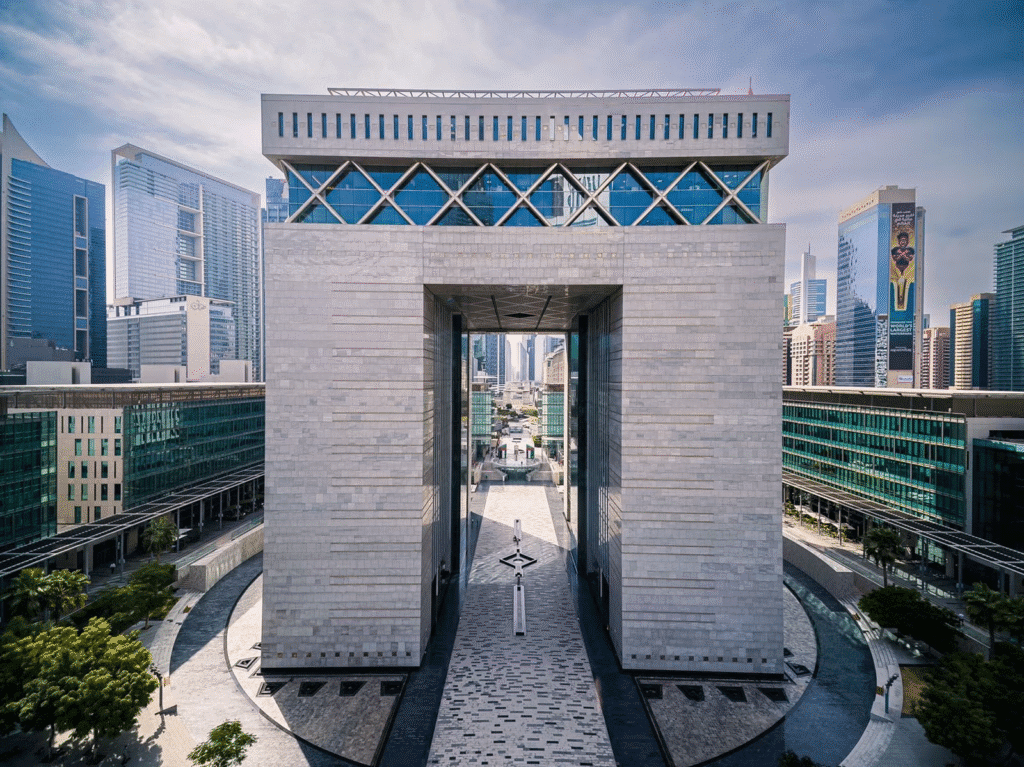

The Role of Dubai International Financial Centre

One of the biggest drivers of Dubai’s success is the Dubai International Financial Centre (DIFC). DIFC has become the region’s leading financial district and a global hub for FinTech innovation. It is home to more than 1,500 technology and innovation firms, which together have raised billions of dollars in funding.

The DIFC Innovation Hub has provided a space for startups and global firms to connect, collaborate, and grow. More importantly, DIFC has positioned Dubai as the only financial centre in the region with both broad and deep capabilities, meaning it is strong across all areas of finance, not just a niche.

Progressive Regulation and Policy

Dubai has taken a unique approach to regulation. Instead of putting up barriers, it has created sandbox environments, flexible licensing, and clear rules for emerging sectors like digital assets. This gives companies the confidence to test and launch new financial technologies without fear of unclear legal frameworks.

This balance between regulation and innovation has helped Dubai attract international firms that might otherwise go to markets like Singapore or London.

Investment, Infrastructure, and Talent

Dubai has invested heavily in the infrastructure needed for a modern FinTech economy. From world-class data centres to smart city initiatives, the city provides an environment where digital finance can thrive.

Equally important is talent. Dubai’s lifestyle, safety, and global connectivity attract skilled professionals from around the world. The funding ecosystem is also growing, with FinTech firms in Dubai raising more than four billion dollars in recent years.

Dubai’s Position in the Rankings

In the latest GFCI report, Dubai ranks 11th overall among global financial centres. In the FinTech category, however, it has broken into the world’s top four. This puts Dubai ahead of several long-established hubs and confirms its reputation as a centre of the future.

Even more impressive, Dubai is ranked first globally for being a financial centre expected to become more significant in the future. This recognition highlights the trust that global players place in Dubai’s long-term potential.

Why Dubai’s Milestone Matters

Dubai’s rise to the top four FinTech hubs has far-reaching implications.

Attracting Global Firms and Talent

Being ranked among the best gives Dubai more visibility and credibility. Global FinTech companies, investors, and accelerators are now more likely to set up operations in the city, bringing in new ideas and talent.

Encouraging Local Innovation

The recognition encourages local entrepreneurs to take risks and build startups. With access to capital and a supportive environment, Dubai-based FinTech firms can grow faster and even expand globally.

Driving Economic Diversification

For the UAE, FinTech is more than just a trend. It is part of the strategy to diversify away from oil dependency. A strong FinTech ecosystem adds resilience and creates high-value jobs for the future economy.

Expanding Regional Influence

Dubai is uniquely positioned as a gateway between Asia, Africa, Europe, and the Middle East. By becoming a top FinTech hub, it can serve as the main launchpad for financial innovation across these regions.

Building Investor Confidence

Global investors pay close attention to rankings like the GFCI. Dubai’s new position gives them confidence that the city is a safe and profitable place to grow their investments.

Challenges Ahead for Dubai

While the recognition is significant, maintaining this position will not be easy.

Keeping Innovation Alive

FinTech evolves quickly. What works today may be outdated tomorrow. Dubai must continue to support innovation and avoid becoming complacent.

Competition from Other Cities

Cities like London, Singapore, and Hong Kong are constantly improving their FinTech ecosystems. Emerging markets in Asia, Africa, and Latin America are also entering the race. Dubai must stay ahead through continuous improvements.

Talent Retention

Attracting global talent is important, but retaining it is even more critical. Dubai needs to ensure long-term opportunities and competitive working environments for professionals in the sector.

Regulatory Balance

Overregulation could slow down innovation, while underregulation could harm investor trust. Dubai must continue to strike the right balance to remain competitive.

Infrastructure and Costs

Maintaining advanced infrastructure requires significant investment. Rising costs could make it harder for smaller startups to operate in the city.

Strategic Priorities for the Future

To maintain its place as a top FinTech hub, Dubai can focus on:

- Updating regulations and keeping them flexible.

- Building stronger partnerships between government, banks, and startups.

- Investing in talent development and education.

- Expanding into new FinTech areas such as insurtech, regtech, and green finance.

- Strengthening its role as a regional hub for Africa, South Asia, and the Middle East.

- Promoting Dubai globally through summits and thought leadership.

What This Means for Stakeholders

For startups and entrepreneurs, Dubai offers a strong platform for growth and funding. For investors and venture capitalists, it provides access to one of the fastest-growing FinTech markets. Banks and financial institutions benefit from easier collaboration with innovative companies, while consumers gain from better financial products and services.

Conclusion

Dubai top FinTech hub is now a reality. By joining the world’s top four FinTech centres in the Global Financial Centres Index, Dubai has proven its ability to compete with the biggest names in global finance.

This achievement reflects years of planning, investment, and innovation. It creates opportunities for entrepreneurs, investors, and the broader economy. However, the journey does not end here. To maintain its position, Dubai must continue to innovate, attract talent, and expand into new areas of financial technology.

The rise of Dubai as a FinTech powerhouse is a story of ambition and execution. The city has shown that with vision, strategy, and determination, it can stand shoulder to shoulder with the world’s leading financial centres.

Do follow UAE Stories on Instagram

Read Next – Dubai Basketball EuroLeague Debut: Bertans Leads Charge