Driving Innovation Through Strategic Partnerships

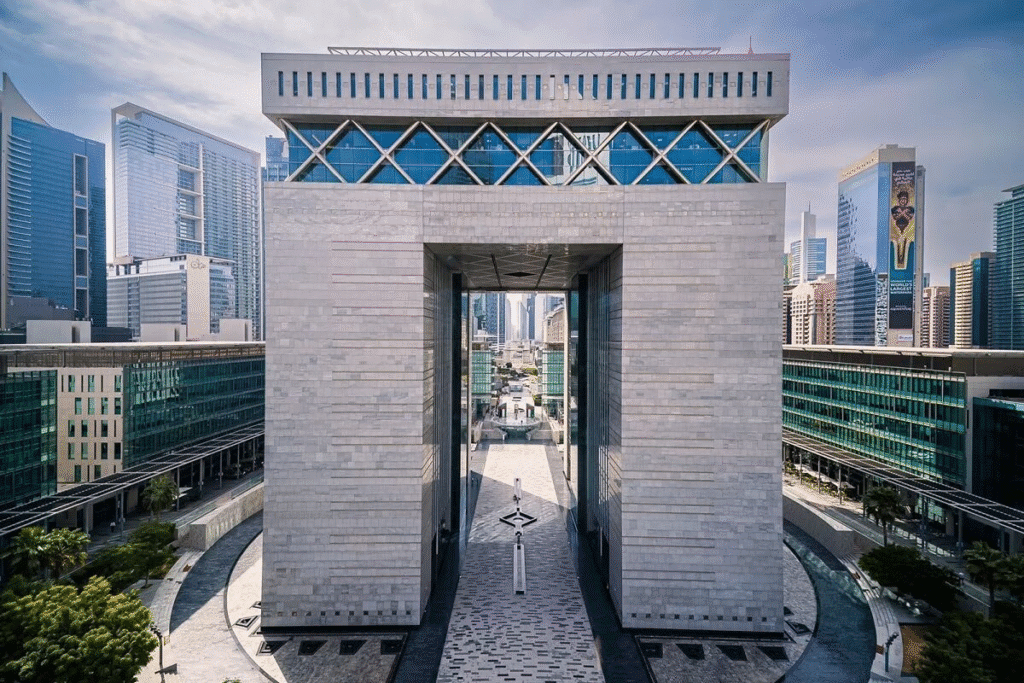

The Dubai Debt Deal between Dubai International Financial Centre (DIFC) and Partners for Growth is transforming the funding landscape for next-generation technology companies. This collaboration provides vital debt financing to startups, allowing them to focus on scaling operations, developing products, and attracting top talent without sacrificing ownership.

The initiative is designed to bridge the funding gap that many high-potential tech startups face during their growth phase. DIFC, renowned for its robust financial ecosystem, and Partners for Growth, a leading investment platform, bring together expertise and resources to help startups scale faster and achieve sustainable success.

Unlocking Opportunities for Emerging Tech Startups

One of the primary goals of this debt deal is to empower technology startups that are shaping the future of industries ranging from artificial intelligence to fintech, renewable energy, and beyond. Access to structured debt financing allows these companies to focus on product development, market expansion, and talent acquisition without diluting ownership.

Startups often struggle with balancing growth ambitions and maintaining equity. By offering flexible debt solutions, DIFC and Partners for Growth provide an alternative to traditional venture capital, giving founders more control over their companies while still gaining access to essential funding.

A Game-Changer for Dubai’s Tech Ecosystem

Dubai has long been a magnet for global investors, entrepreneurs, and innovators. This latest collaboration reinforces the city’s commitment to becoming a world-leading tech hub. By offering financial backing through structured debt, the initiative lowers the risk for startups and encourages more entrepreneurs to bring their disruptive solutions to market.

The move also signals a broader trend of financial institutions embracing innovative funding models. Startups are no longer limited to equity financing alone. Access to debt solutions helps maintain healthy capital structures, ensures long-term sustainability, and positions companies for future rounds of growth or potential acquisitions.

Strengthening Investor Confidence and Market Dynamics

The partnership between DIFC and Partners for Growth not only benefits startups but also boosts investor confidence in Dubai’s tech landscape. Investors are increasingly looking for markets where the ecosystem supports both innovation and financial stability. By introducing debt financing options, the initiative provides a safety net that makes investments in early-stage companies more attractive and less risky.

Additionally, this collaboration highlights Dubai’s readiness to adopt global best practices in fintech and venture financing. It strengthens the city’s reputation as a forward-thinking, investment-friendly destination, attracting international attention and increasing the inflow of capital.

Fostering Sustainable Growth and Global Competitiveness

Beyond immediate financial support, the initiative aims to foster sustainable growth within the tech sector. Access to debt capital allows startups to plan long-term strategies, invest in research and development, and expand globally. This not only benefits individual companies but also elevates the overall competitiveness of Dubai’s tech ecosystem on the international stage.

Moreover, the focus on next-generation technology ensures that Dubai remains at the forefront of emerging industries. Startups working on AI, blockchain, clean energy, and other transformative technologies will have the resources needed to turn innovative concepts into market-ready solutions.

Collaboration as a Catalyst for Success

The partnership exemplifies the power of collaboration in driving innovation. DIFC brings regulatory expertise, access to global markets, and a network of financial institutions, while Partners for Growth contributes flexible financing solutions and deep industry insights. Together, they create an environment where startups can thrive without compromising their vision or autonomy.

Such collaborations are increasingly becoming the blueprint for successful startup ecosystems worldwide. By aligning the interests of investors, financial institutions, and entrepreneurs, Dubai is fostering a culture of mutual growth and long-term prosperity.

Looking Ahead: Shaping the Future of Tech in Dubai

The impact of this debt financing initiative will likely extend far beyond immediate funding. As startups gain access to resources and mentorship, the quality and scale of innovation in Dubai are expected to accelerate rapidly. This momentum can attract further investment, create high-value jobs, and solidify Dubai’s position as a global technology hub.

By supporting the next generation of tech companies, DIFC and Partners for Growth are not just funding businesses—they are investing in a vision of Dubai as a center of technological excellence, innovation, and sustainable economic growth.

Conclusion

Dubai’s new debt deal, backed by DIFC and Partners for Growth, represents a transformative step for the city’s tech ecosystem. By providing structured funding to emerging technology companies, this initiative empowers entrepreneurs, strengthens investor confidence, and accelerates innovation. The collaboration demonstrates how strategic partnerships can drive sustainable growth, foster global competitiveness, and shape the future of technology in the region. With this powerful alliance, Dubai is not only supporting startups today but also building the foundation for a thriving, innovative economy for years to come.

Do follow UAE Stories on Instagram

Read Next – Mercedes Welcomes EV Rivals as Competition Heats Up for Gulf Buyers