Building a strong credit score in the UAE is essential for financial stability and unlocking better financial opportunities. A good credit score not only helps you get loans and credit cards easily but also ensures lower interest rates and better repayment terms. Many residents in the UAE are unaware of how credit scores work and how to improve them effectively.

Understanding Credit Score in UAE

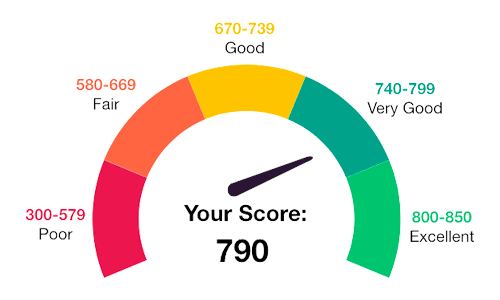

A credit score is a numerical representation of your creditworthiness. In the UAE, this score is calculated by Al Etihad Credit Bureau (AECB) based on your financial behavior, including borrowing, repayment, and outstanding debts. Scores typically range from 300 to 900, with higher scores indicating better financial health.

A good credit score reflects your reliability as a borrower. Banks and financial institutions in the UAE rely heavily on this score to approve loans, mortgages, or credit card applications. Maintaining a good score is not just about getting credit; it shows financial responsibility.

Check Your Current Credit Score

Before planning to improve your credit score, it’s important to know where you currently stand. The AECB allows individuals to check their credit scores online. Regularly monitoring your credit score helps you understand your financial habits, spot errors, and take corrective actions.

Checking your score doesn’t negatively impact it. In fact, it is a proactive step to manage your financial reputation and prepare for future financial goals like buying a home or a car.

Pay Your Bills on Time

One of the most critical factors affecting your credit score is timely repayment of loans and bills. Late payments, missed payments, or defaults can significantly lower your credit score. Setting up reminders or automatic payments for utility bills, credit cards, and loans can help ensure timely payments.

Consistency in paying bills on time demonstrates responsibility to financial institutions. Over time, this positive behavior reflects in your credit score, making it easier to access larger loans and better credit facilities.

Manage Your Debt Wisely

Maintaining a healthy balance between credit used and available credit is essential. Avoid maxing out credit cards or accumulating unnecessary debt. Financial experts recommend using no more than 30-40% of your available credit.

Paying down high-interest debt first and avoiding taking multiple loans simultaneously can also improve your credit profile. Responsible debt management shows that you can handle borrowed money efficiently.

Use Credit Cards Responsibly

Credit cards are both a tool and a responsibility. Using them responsibly can help build a good credit score. Avoid overspending, pay off balances in full every month, and avoid applying for multiple cards in a short period.

Regular use of a credit card for small purchases and repaying on time proves your financial discipline. This helps banks see you as a trustworthy borrower and can increase your credit limit over time.

Keep Your Credit History Healthy

The length and quality of your credit history impact your score. Avoid closing old accounts unnecessarily and focus on maintaining a long-standing history with consistent repayments. A longer credit history provides more data to lenders, indicating your ability to manage credit responsibly.

If you are new to credit, start small with a secured credit card or a personal loan and gradually build your record. Over time, this will create a strong foundation for a higher credit score.

Avoid Frequent Loan Applications

Applying for multiple loans or credit cards in a short period can negatively affect your credit score. Each application results in a “hard inquiry,” which signals lenders that you may be financially stressed.

Space out your applications and only apply for credit when necessary. Thoughtful planning and cautious borrowing demonstrate financial stability, which positively influences your credit score.

Regularly Monitor Your Credit Report

Errors on your credit report can lower your score unfairly. Check your credit report at least twice a year to ensure all information is accurate. Dispute any discrepancies with the AECB immediately to avoid long-term negative impact.

A clean credit report ensures your score reflects your true financial behavior. Proactive monitoring also helps you identify potential identity theft or fraud early.

Build a Balanced Financial Profile

A good credit score is not just about paying bills on time. Maintaining a balanced financial profile that includes timely payments, responsible debt management, long credit history, and limited applications for new credit creates a holistic picture of financial responsibility.

Combining all these strategies will gradually improve your credit score and provide better access to financial opportunities, such as higher loan approvals, lower interest rates, and premium credit facilities.

Final Thoughts

Building a good credit score in the UAE requires patience, discipline, and smart financial choices. By paying bills on time, managing debt wisely, using credit responsibly, and monitoring your credit report regularly, you can steadily improve your score.

A strong credit score is not only a number; it represents your financial reliability and opens doors to a better future. Start today, and take control of your financial health in the UAE.

Do follow UAE Stories on Instagram

Read Next – Upgrade Your Space with Dubai’s Best Home Decor Finds