In a bold move to redefine the digital banking experience in the UAE, Emirates NBD has unveiled a suite of new AI-powered digital services designed to make banking smarter, more personalised, and incredibly intuitive. These new offerings are part of the bank’s broader digital transformation strategy aimed at delivering seamless customer experiences using the latest in artificial intelligence technology.

This latest development strengthens Emirates NBD’s reputation as one of the most forward-thinking banks in the region. With over 60 years in the banking industry, the bank is once again proving its ability to evolve with the times by bringing innovation straight to the fingertips of its customers.

A Glimpse into the Future of Banking

The new AI-driven services introduced by Emirates NBD focus on enhancing customer interaction and decision-making processes. Whether it’s managing daily transactions, receiving personalised financial advice, or resolving issues in real time, these services have been designed to respond swiftly and intelligently to customer needs.

One of the standout features is the AI-powered virtual assistant. This tool offers customers real-time support, helping them with a range of services from checking account balances to answering complex queries. Unlike traditional bots, this AI assistant understands context, learns from interactions, and becomes more helpful over time.

These developments also include AI-driven financial wellness tools that offer tailored advice based on the customer’s spending habits and financial goals. Imagine your bank nudging you to save a little more this month because it noticed a trend in your expenses—without being intrusive. That’s the level of personalisation Emirates NBD is aiming for.

Mobile-First and Customer-Centric

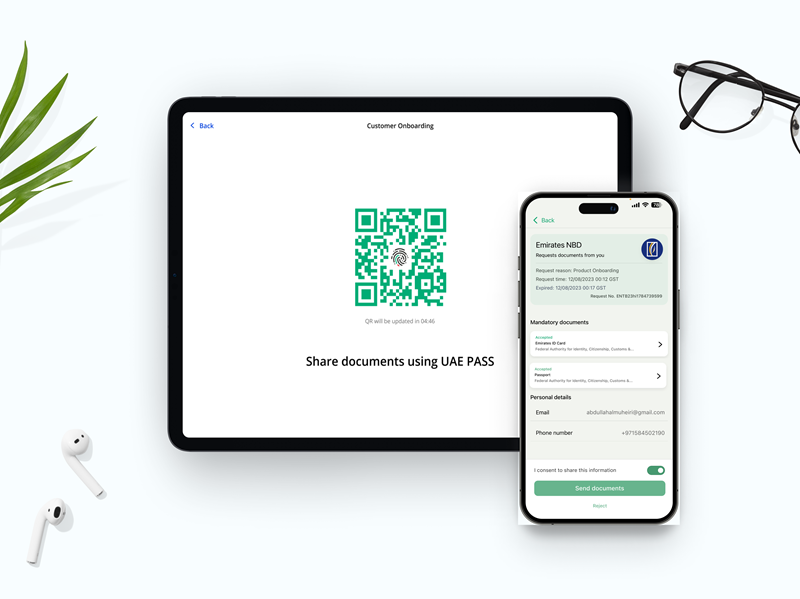

The launch further aligns with the UAE’s growing mobile-first economy, where consumers expect fast and frictionless digital experiences. Emirates NBD has already been a pioneer in mobile banking, but this update supercharges that commitment.

With the latest version of the Emirates NBD mobile app, users can now experience smoother navigation, faster logins using biometric authentication, and an intelligent home screen that adapts to user behaviour. If a customer routinely transfers money at the end of the month, the app will begin to pre-emptively offer shortcuts to this service. It’s not just mobile banking anymore—it’s predictive banking.

AI in Action: Fraud Detection and Security

One of the major wins of AI in banking is enhanced security. Emirates NBD has integrated advanced machine learning algorithms to detect fraud in real-time. This system analyses thousands of data points per second, identifying patterns that could suggest fraudulent activity.

If a suspicious transaction is spotted, the AI system can instantly alert the customer and temporarily freeze the transaction until further verification. This kind of proactive security helps build trust and gives customers peace of mind—especially in today’s digital-first financial landscape.

Empowering Businesses Too

While retail customers will immediately benefit from these upgrades, Emirates NBD hasn’t left its business clients behind. The AI enhancements also include services for SMEs and corporates, such as predictive cash flow tools, automated invoice management, and intelligent portfolio analysis.

These solutions are tailored to support financial decision-making at scale. For example, a small business owner can now receive insights about their monthly inflows and outflows, alongside smart suggestions to manage cash reserves or access credit lines more efficiently.

Pushing the Envelope on Innovation

This rollout isn’t a standalone initiative. It forms part of Emirates NBD’s larger vision to be a leading digital bank, not just in the UAE, but globally. The bank has committed billions of dirhams over the past few years toward digital innovation, and these AI-driven services are the latest evidence of that commitment.

The move is also aligned with the UAE’s broader vision to become a global leader in AI and fintech. By investing in these technologies, Emirates NBD supports national goals and helps drive the entire financial sector forward.

Inclusive, Easy, and Always On

A big part of this transformation is about accessibility. The AI services are built to be intuitive and user-friendly for customers of all ages and digital comfort levels. From chat-based banking for younger users to voice-activated features for the elderly, the new system is inclusive by design.

And perhaps the most compelling feature of all is that these services are always on. Whether it’s a public holiday or late at night, customers can get help, make decisions, and manage their finances at their own pace, without waiting in line or on hold.

Backlink: Explore More with Emirates NBD

To discover more about these AI-powered services and what they can do for your personal or business banking, visit www.emiratesnbd.com. The site also offers demos, FAQs, and a customer portal to make the transition to smarter banking as smooth as possible.

A Game-Changer for UAE Banking

This launch is not just an upgrade—it’s a transformation. Emirates NBD’s integration of AI into its core services is poised to change how people interact with their banks. From daily convenience to long-term financial planning, AI is stepping in to make things simpler, smarter, and more secure.

For customers, this means a future where banking feels more like a conversation with a personal advisor than a series of transactions. And for the UAE, it means another powerful step towards leading the global charge in digital innovation.

Also read: Sheikh Hamdan Unveils New Education Council Members