In a bold step signaling the growing economic synergy between the Middle East and Southeast Asia, the Abu Dhabi Investment Authority (ADIA), the world’s fourth-largest sovereign wealth fund, is making strategic moves to expand its footprint in Vietnam. With a portfolio estimated at over $830 billion in global assets, ADIA’s decision to deepen its investments in Vietnam showcases the UAE’s long-term vision to forge high-growth alliances in key emerging markets and further economic diplomacy.

A Vision of Growth: UAE-Vietnam Relations Strengthen

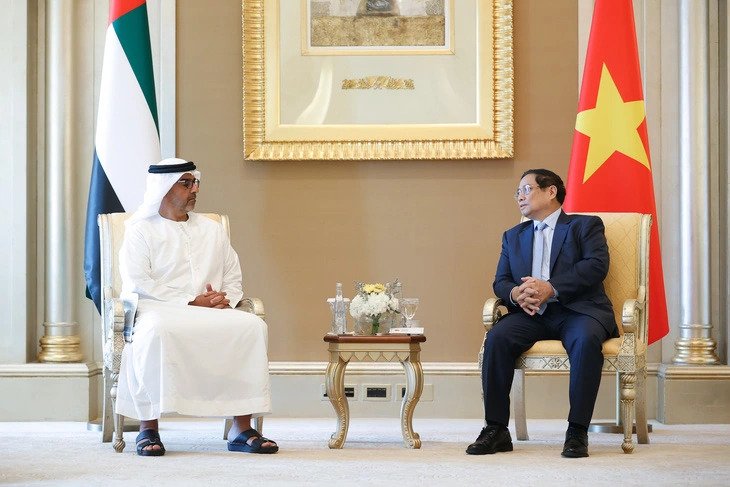

Vietnam and the UAE have shared a productive bilateral relationship over the years, particularly in trade and economic development. This connection received a significant boost in October 2024, when Vietnamese Prime Minister Pham Minh Chinh visited the United Arab Emirates. During his visit, he held high-level discussions with Sheikh Hamed Bin Zayed Al Nahyan, Managing Director of ADIA, to explore investment opportunities in various sectors across Vietnam.

Sheikh Hamed conveyed ADIA’s keen interest in broadening its presence in Vietnam, citing the country’s rapid economic transformation, business-friendly environment, and openness to foreign investment as prime motivators. His remarks included not only expanding direct investments but also supporting Vietnam in developing its own domestic investment funds—a powerful nod to capacity building and knowledge transfer.

This strategic pivot fits perfectly into ADIA’s long-term approach. Known for its conservative yet forward-thinking investment strategy, ADIA tends to favor countries with stable growth trajectories, political stability, and pro-investment frameworks. Vietnam, with its burgeoning middle class, expanding industrial base, and strategic location in Southeast Asia, emerges as a compelling option.

A Portfolio Already in Motion

ADIA’s interest in Vietnam is not purely speculative—it already maintains a presence in the country through significant stakes in major corporate ventures. One of its most prominent moves involved its subsidiary, Platinum Orchid, acquiring a major equity position in The CrownX Joint Stock Company (TCX), a key asset under Vietnam’s Masan Group Corporation.

This stake in CrownX—an entity that houses both consumer retail and FMCG businesses—demonstrates ADIA’s confidence in Vietnam’s domestic consumption story. As the nation continues to urbanize, digitalize, and climb the value chain, sectors such as retail, consumer goods, healthcare, logistics, and technology are ripe for large-scale foreign investment. ADIA’s participation in this space reinforces its position as a forward-thinking investor aligned with long-term demographic trends.

The fund is also reportedly evaluating Vietnam’s growing infrastructure and green energy sectors, alongside high-technology industries like semiconductors and digital innovation—areas that are central to Vietnam’s vision of becoming a high-income country by 2045.

AIM Congress 2025: Furthering the Dialogue

ADIA’s strategic interests were further affirmed in April 2025 when Vietnam’s Deputy Prime Minister Nguyen Chi Dung met Khadem AlRemeithi, Executive Director of ADIA’s Infrastructure Department, during the Annual Investment Meeting (AIM) Congress in Abu Dhabi.

The AIM Congress, one of the world’s leading investment platforms, was a natural setting for such dialogue. Deputy PM Dung emphasized Vietnam’s ambition to become a regional hub for high-tech industries and financial services. He invited ADIA to consider specific co-investments in infrastructure projects, especially those linked to green energy, smart cities, logistics, and national highways.

He also extended an invitation for ADIA to participate in setting up investment funds that support science, innovation, and private sector competitiveness in Vietnam. This move would help mobilize both domestic and international capital into Vietnam’s burgeoning innovation ecosystem—an area where ADIA could offer unparalleled global expertise.

Building Financial Bridges and Economic Ambitions

Vietnam’s interest in attracting large institutional investors like ADIA is rooted in its vision to become a more diversified, innovation-driven economy. With a GDP that has consistently grown above 6% annually in recent years, Vietnam offers solid macroeconomic fundamentals. Coupled with its large and young workforce, strategic access to regional supply chains, and commitment to international trade agreements, it positions itself as a natural destination for Gulf capital.

In return, ADIA stands to benefit from long-term capital appreciation in an economy undergoing sustained transformation. Vietnam’s recent investments in renewable energy, digital infrastructure, and public-private partnerships in transportation create ample opportunities for institutional players.

Furthermore, both Vietnam and the UAE have signed a Comprehensive Economic Partnership Agreement (CEPA), which will significantly reduce tariffs and non-tariff barriers, foster easier capital flows, and encourage bilateral cooperation in various sectors including logistics, agriculture, fintech, and services.

A Broader Strategy: The UAE’s Southeast Asia Play

ADIA’s expansion into Vietnam is part of a broader strategic push by UAE investment institutions to establish a stronger presence in Southeast Asia. Just months before ADIA’s renewed focus on Vietnam, another Abu Dhabi-based fund, ADQ, signed a memorandum of understanding with Vietnam’s State Capital Investment Corporation (SCIC) to explore joint investments in state-owned enterprises and key development projects.

This growing appetite from UAE sovereign wealth funds highlights a structural shift: Middle Eastern capital is increasingly looking East. While traditional investments have long targeted the U.S. and European markets, sovereign wealth funds are now diversifying into high-growth regions with expanding consumer markets and strategic geopolitical relevance.

Vietnam, located at the heart of ASEAN and boasting close trade ties with the U.S., China, and EU, is fast becoming a magnet for such capital inflows. With recent supply chain shifts favoring Vietnam as an alternative manufacturing hub, the country is experiencing a golden window for foreign direct investment.

Looking Ahead: A Shared Future of Prosperity

The message is clear—ADIA’s interest in Vietnam is not a one-off event but part of a deeper and more strategic economic alliance between the UAE and Southeast Asia. For Vietnam, this engagement means more than just capital—it brings credibility, knowledge, and access to global financial networks. For the UAE, particularly ADIA, it represents a step into a high-potential market that aligns with its mission to invest wisely across a diversified global portfolio.

As both nations continue to explore ways to deepen this cooperation—through sovereign partnerships, green initiatives, and innovation-led ventures—their collaboration stands as a model for cross-regional economic diplomacy. With global capital flows increasingly influenced by geopolitical stability and sustainable development goals, Vietnam and the UAE’s partnership emerges as one of the more promising blueprints for the future.

In a world where resilience, growth, and collaboration are the cornerstones of progress, ADIA’s expanding role in Vietnam is not just a smart investment—it’s a strategic move toward a more interconnected and prosperous future.

Do follow Uae stories for more Updates

Strengthening Ties: UAE and Indonesia Forge Eight New Agreements in Abu Dhabi