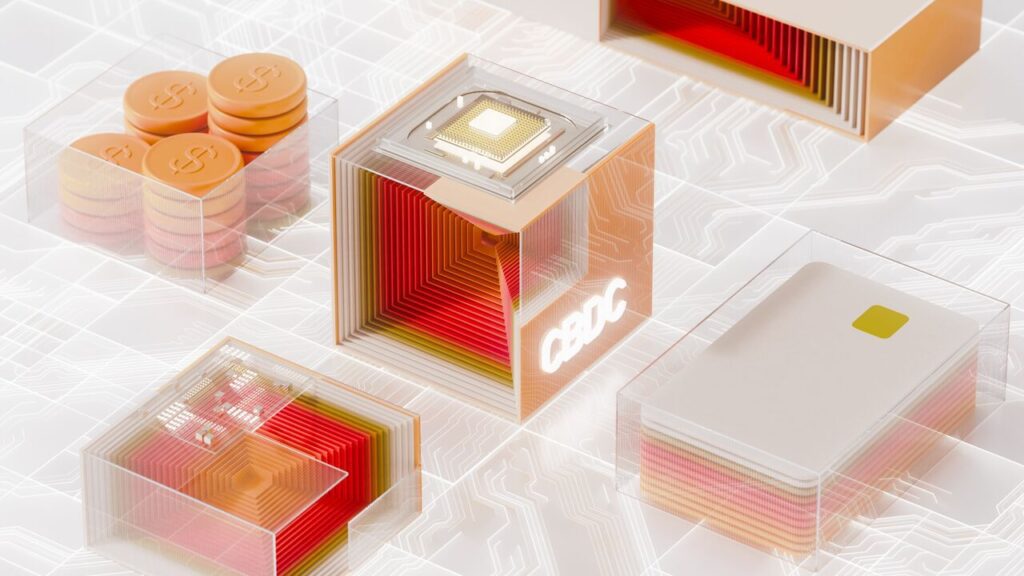

Saudi Arabia has officially joined a groundbreaking digital currency initiative alongside China, the UAE, and other key international players, signaling a major shift in the global financial landscape. This strategic move positions the Kingdom as a leading force in the future of digital finance, leveraging blockchain technology and central bank digital currencies (CBDCs) to revolutionize cross-border transactions, trade, and economic integration.

A Step Towards Financial Innovation

Saudi Arabia’s decision to participate in the multi-national digital currency project reflects its broader vision of becoming a global financial and technological hub. The initiative aligns with Vision 2030, the Kingdom’s ambitious economic diversification plan, which emphasizes technological advancement, digital transformation, and financial inclusion.

By collaborating with China and the UAE—both pioneers in the CBDC space—Saudi Arabia is positioning itself at the forefront of digital currency adoption, ensuring seamless transactions and enhanced economic partnerships within the region and beyond.

The mBridge Project: A Game-Changer in Cross-Border Payments

Saudi Arabia’s entry into the initiative is closely linked to Project mBridge, a cross-border CBDC payment network led by the Bank for International Settlements (BIS), the People’s Bank of China (PBOC), the Central Bank of the UAE (CBUAE), the Hong Kong Monetary Authority (HKMA), and the Bank of Thailand.

Project mBridge aims to:

- Reduce transaction costs associated with cross-border payments.

- Enhance financial security by using blockchain technology.

- Improve transaction efficiency, making payments faster and more transparent.

- Eliminate reliance on traditional banking systems, streamlining global trade.

With Saudi Arabia joining the initiative, the project now includes some of the largest economies in the Middle East and Asia, marking a pivotal shift in global financial power towards emerging markets.

Saudi Arabia’s Interest in Digital Currencies

Saudi Arabia has been actively exploring digital currency applications in recent years. The Saudi Central Bank (SAMA) previously conducted joint digital currency research with the UAE, under Project Aber, which tested a dual-issued digital currency for cross-border transactions. The successful completion of that project laid the foundation for Saudi Arabia’s deeper involvement in international CBDC initiatives.

By joining mBridge, Saudi Arabia seeks to:

- Develop a seamless financial ecosystem for businesses operating within and beyond the region.

- Enhance monetary policy tools, giving the central bank better control over liquidity and inflation.

- Boost financial inclusivity, enabling faster, more affordable transactions for individuals and companies.

This strategic move also strengthens Saudi Arabia’s ties with China, further cementing their economic partnership amid growing trade and investment collaboration.

China’s Leadership in the CBDC Space

China has been a global leader in the development of digital currencies, with its digital yuan (e-CNY) already being piloted across multiple cities and used for cross-border transactions. The country’s central bank, PBOC, has played a key role in pushing for international cooperation on CBDCs, with mBridge serving as a key platform for digital currency innovation.

By working alongside China, Saudi Arabia gains first-hand access to advanced digital currency infrastructure, setting the stage for:

- Faster and more efficient trade transactions between the two nations.

- Stronger financial connectivity between the Middle East and Asia.

- A shift away from the US dollar’s dominance in international trade.

The UAE’s Role as a Digital Finance Powerhouse

The UAE has been at the forefront of digital finance, with the Central Bank of the UAE (CBUAE) playing a critical role in promoting blockchain-based financial solutions. The UAE’s involvement in Project Aber and mBridge demonstrates its commitment to financial innovation and cross-border digital currency adoption.

Saudi Arabia’s collaboration with the UAE in this initiative strengthens the Gulf region’s position as a global financial hub, further attracting foreign investments, fintech startups, and multinational corporations seeking efficient payment solutions.

How This Impacts the Global Financial System

Saudi Arabia’s participation in the digital currency initiative carries significant global implications. As more countries develop and adopt CBDCs, the traditional financial system could witness:

- Reduced reliance on the US dollar for cross-border transactions.

- Greater financial autonomy for emerging economies, allowing them to bypass traditional banking systems.

- A more inclusive financial system, benefiting businesses and individuals in underbanked regions.

- A shift in global economic power towards digital-first economies.

With major players like China, the UAE, and now Saudi Arabia driving digital currency adoption, the future of global finance is set to undergo a profound transformation.

What’s Next for Saudi Arabia’s Digital Currency Strategy?

Saudi Arabia’s involvement in Project mBridge is expected to be just the beginning of its digital finance ambitions. Moving forward, the Kingdom is likely to:

- Expand its CBDC pilot programs, testing real-world applications of digital currencies.

- Invest in blockchain infrastructure, supporting fintech companies and startups.

- Strengthen regulatory frameworks, ensuring smooth adoption of digital assets.

- Enhance collaboration with global financial institutions, positioning itself as a leader in digital finance.

With its strategic location, strong economic foundation, and commitment to innovation, Saudi Arabia is well on its way to becoming a key player in the future of digital finance.

Conclusion

Saudi Arabia’s decision to join China and the UAE in a global digital currency project marks a major milestone in the evolution of financial technology. By embracing CBDCs and blockchain-based payment networks, the Kingdom is aligning itself with the future of digital finance, strengthening its role in global trade, financial innovation, and economic integration.

As this initiative progresses, the world will witness a new era of borderless digital transactions, where emerging economies take center stage in reshaping the financial landscape.

Do follow Uae stories for more Updates

Dubai Stadium Implements Strict Spectator Rules for Champions Trophy 2025