Setting up a company in Ras Al Khaimah (RAK) has become one of the smartest business decisions for entrepreneurs, startups, and international investors looking for cost-effective expansion in the UAE. RAK is known for offering affordable licensing packages, simplified procedures, and business-friendly regulations compared to other emirates.

If you are considering launching your venture in one of RAK’s free zones, understanding the actual setup costs is essential. This guide breaks down everything you need to know in a practical and human way — from license fees to hidden expenses — so you can plan confidently.

Why Choose RAK Free Zones?

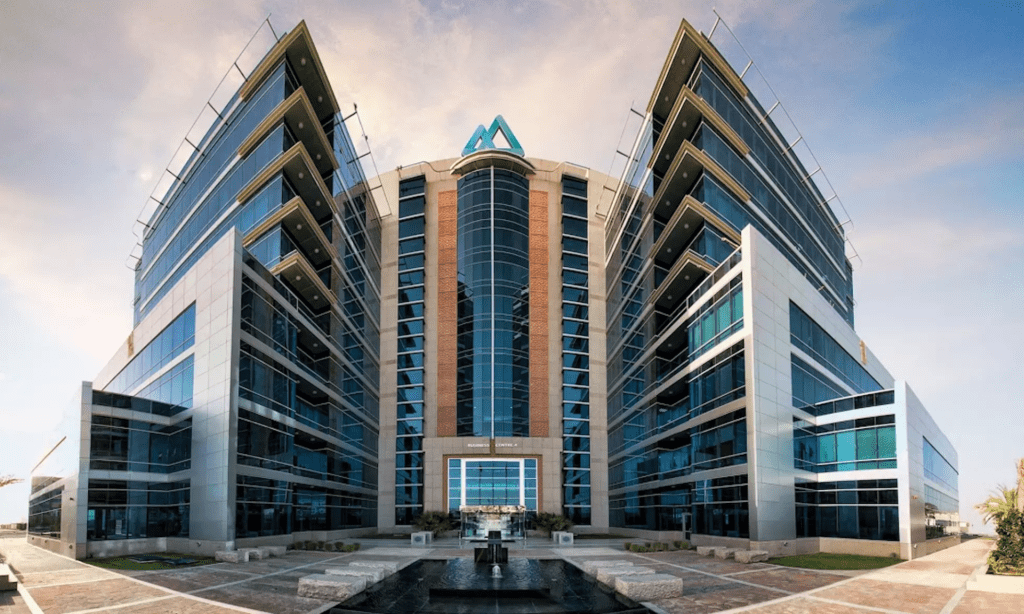

RAK has positioned itself as a competitive alternative to Dubai and Abu Dhabi by offering lower operational costs without compromising on infrastructure or credibility. The two main free zones operating in Ras Al Khaimah are:

- RAK Free Trade Zone

- RAK Maritime City

In recent years, these authorities have streamlined services to attract global investors, particularly SMEs, consultants, e-commerce entrepreneurs, and industrial businesses.

Key advantages include:

- 100% foreign ownership

- 100% repatriation of profits

- Zero corporate and personal income tax (subject to UAE tax regulations)

- Flexible office solutions

- Fast company registration process

The biggest attraction, however, remains cost efficiency.

Understanding RAK Free Zones Business Setup Costs

The cost of starting a business in RAK depends on several factors:

- Type of license

- Number of visas required

- Office or facility space

- Nature of activity

Let’s break down each element.

License Costs in RAK Free Zones

The license fee is the foundation of your setup cost. RAK offers different license categories:

Commercial License

Suitable for trading and general trading activities.

Average cost: AED 10,000 – AED 15,000 per year

Service License

Ideal for consultants, freelancers, and professionals offering services.

Average cost: AED 8,000 – AED 12,000 per year

Industrial License

Designed for manufacturing or production businesses.

Average cost: AED 15,000 – AED 25,000 depending on activity and facility size

The final amount varies depending on the free zone authority, the number of business activities listed, and whether you choose a promotional package.

Registration and Incorporation Fees

In addition to the license fee, you must pay a one-time registration and incorporation charge.

Typical registration fees range between AED 3,000 – AED 5,000.

This covers:

- Company name reservation

- Legal documentation

- Memorandum and Articles of Association

- Business registration certificate

These are mandatory costs and are paid during the initial setup.

Office Space and Facility Costs

Free zones require businesses to lease a physical presence. The cost depends on your operational needs.

Flexi Desk

Best for startups and small businesses.

Cost: AED 5,000 – AED 8,000 annually

This option provides shared workspace and limited visa eligibility.

Private Office

Cost: AED 15,000 – AED 40,000 annually

Suitable for growing businesses requiring privacy and additional visas.

Warehouses and Industrial Units

Cost: AED 50,000 and above depending on size and location

Industrial and logistics businesses benefit significantly from competitive warehouse pricing compared to other emirates.

Visa Costs in RAK Free Zones

If you plan to reside in the UAE or hire employees, visa costs must be considered.

Average cost per visa (including medical test, Emirates ID, and stamping): AED 3,000 – AED 5,000

The number of visas allowed depends on the office type. Flexi desks typically allow 1–2 visas, while larger offices permit more.

Additional Costs to Consider

While RAK is known for transparency, you should budget for:

- Establishment card: AED 1,500 – AED 2,000

- Immigration file opening: AED 1,000 – AED 2,000

- Bank account setup (varies by bank)

- Audit services (if required)

- Renewal fees (similar to first-year license fee)

Planning for these ensures you avoid surprises.

Total Estimated Setup Cost in RAK Free Zones

For a small consultancy with a flexi desk and one visa, the estimated total cost may range between:

AED 18,000 – AED 30,000

For a trading company requiring office space and multiple visas, the cost may range between:

AED 35,000 – AED 70,000

Industrial setups will naturally require a larger investment depending on facility size and operational scale.

Compared to other UAE emirates, RAK remains one of the most affordable free zone destinations.

How RAK Compares to Other UAE Free Zones

While Dubai free zones can cost AED 40,000 to AED 70,000 for basic setups, RAK provides similar licensing advantages at significantly lower prices. This makes it particularly attractive for entrepreneurs testing new markets or running remote businesses.

Moreover, RAK’s strategic location offers access to seaports, airports, and highways connecting the rest of the UAE and GCC region.

Step-by-Step Business Setup Process

Understanding the process also helps you estimate timelines and costs.

Step 1: Choose Business Activity

Select from approved activity lists provided by the free zone authority.

Step 2: Choose License Type

Commercial, service, or industrial.

Step 3: Select Office Package

Flexi desk, office, or warehouse.

Step 4: Submit Documents

Typically required:

- Passport copy

- Visa copy (if applicable)

- Passport-size photo

- Application form

Step 5: Pay Fees and Receive License

After payment, the license is usually issued within a few working days.

Step 6: Apply for Visas

Complete medical tests, Emirates ID registration, and visa stamping.

The process is designed to be efficient and investor-friendly.

Is RAK Free Zone Right for You?

RAK is ideal for:

- Freelancers and consultants

- E-commerce businesses

- SMEs expanding into the Middle East

- Industrial manufacturers seeking cost-efficient facilities

- Investors wanting 100% ownership

However, if your business depends heavily on Dubai walk-in traffic or luxury branding, you may need to weigh branding considerations against cost savings.

Final Thoughts

RAK Free Zones provide one of the most cost-effective gateways into the UAE market. With license packages starting under AED 10,000 and flexible office solutions, entrepreneurs can launch with manageable investment and scale gradually.

The key to a successful setup lies in understanding your operational needs, calculating visa requirements carefully, and selecting the right office package.

When planned strategically, RAK Free Zones offer exceptional value, financial efficiency, and long-term growth potential in a stable business environment.

Do follow UAE Stories on Instagram

Read Next – Is Living in Sharjah Worth It for Dubai Workers?