Navigating the world of banking can be a bit overwhelming, especially when you’re trying to understand the ATM daily withdrawal limit in the UAE. With a variety of banks offering different policies, knowing how much cash you can access daily is crucial for effective financial management. This article will guide you through the aspects of ATM withdrawal limits, why they exist, and how they can affect your daily life in the UAE.

What Is the ATM Daily Withdrawal Limit in the UAE?

The ATM daily withdrawal limit in the UAE refers to the maximum amount of cash a cardholder can withdraw from an Automated Teller Machine (ATM) within a 24-hour period. Most banks in the UAE set these limits to enhance security and manage customer transactions effectively.

Different banks may have varying limits, typically ranging from AED 1,000 to AED 5,000 per day. This variance can be attributed to several factors, including the type of account you hold, your banking history, and the bank’s internal policies.

Why Do Banks Set Withdrawal Limits?

Understanding why banks impose ATM daily withdrawal limits in the UAE is essential for consumers. Here are some key reasons:

Enhanced Security: Limiting cash withdrawals helps reduce the risk of fraud. If a card is stolen, the thief cannot withdraw large sums of money at once.

Cash Flow Management: Banks need to manage their liquidity. By controlling how much cash can be withdrawn, they ensure that there are sufficient funds available for other customers.

Customer Protection: Withdrawal limits can help prevent impulsive spending. By limiting access to large amounts of cash, banks encourage responsible financial behavior.

Common Withdrawal Limits Across UAE Banks

Most major banks in the UAE have set their ATM daily withdrawal limits based on customer needs and market standards. Here’s a brief overview of the withdrawal limits for some of the prominent banks:

Emirates NBD: AED 3,000 for regular accounts, with higher limits available for premium accounts.

Abu Dhabi Commercial Bank (ADCB): AED 5,000 for personal accounts, but this can vary.

FAB (First Abu Dhabi Bank): AED 2,500 for standard accounts, with options for higher limits on request.

RAK Bank: AED 1,500 for standard accounts, with the possibility of increasing upon request.

How to Increase Your ATM Withdrawal Limit

If you find that the ATM daily withdrawal limit in the UAE does not meet your needs, there are steps you can take to increase it. Here are some options:

Contact Your Bank: Most banks allow customers to request an increase in their daily withdrawal limit. You can either call customer service or visit a branch.

Upgrade Your Account: Premium accounts often come with higher withdrawal limits. Consider upgrading if it aligns with your banking needs.

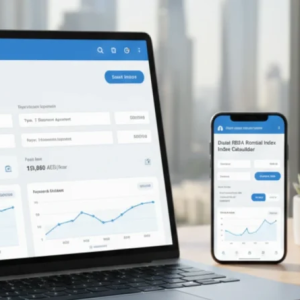

Use Online Banking: Many banks offer the option to manage withdrawal limits through their online banking platforms. Check if your bank provides this feature.

Tips for Managing Your Cash Withdrawals

Managing your cash withdrawals efficiently can help you make the most of the ATM daily withdrawal limit in the UAE. Here are some practical tips:

Plan Your Withdrawals: Assess your weekly or monthly cash needs and plan your withdrawals accordingly to avoid hitting your limit unexpectedly.

Use ATMs Wisely: Familiarize yourself with the nearest ATMs and their withdrawal limits. Some banks have a network of ATMs that may offer higher limits.

Keep Track of Your Transactions: Regularly monitor your bank statements to keep an eye on your cash flow. This will help you manage your withdrawals better.

The Future of ATM Withdrawal Limits in the UAE

As technology continues to evolve, so will banking practices. The ATM daily withdrawal limit in the UAE may change in response to innovations in the financial sector. With the rise of digital banking and cashless transactions, it’s possible that banks will adjust their policies to meet changing consumer behaviors.

Moreover, enhanced security measures and new financial technologies may lead to more flexible withdrawal limits in the future. Customers should stay informed about their bank’s policies to adapt to these changes.

Conclusion: Navigating Your ATM Withdrawal Needs in the UAE

Understanding the ATM daily withdrawal limit in the UAE is essential for effective financial management. By being aware of your bank’s policies and how to navigate them, you can ensure that you have access to the cash you need when you need it. Whether you’re a resident or a visitor, knowing these limits will empower you to manage your finances more effectively in the UAE.

Do follow UAE Stories on Instagram

Read Next – Cash Deposit Limit in UAE: Complete Rules Explained