Understanding Mortgage Options in the UAE: Fixed vs Variable Rates

Navigating the world of mortgage options in the UAE can feel overwhelming, especially with the choice between fixed and variable rates. Whether you are a first-time buyer or looking to refinance, understanding the pros and cons of each option is crucial for making an informed decision. This guide will delve into the intricacies of mortgage options in the UAE, helping you choose what best suits your financial situation.

Why Choosing the Right Mortgage Matters

Choosing the right mortgage option can significantly impact your financial health over time. With property prices fluctuating in the UAE, understanding how fixed and variable rates work is essential. A well-informed decision can save you money and provide peace of mind as you invest in your home.

The Basics of Fixed Rate Mortgages in the UAE

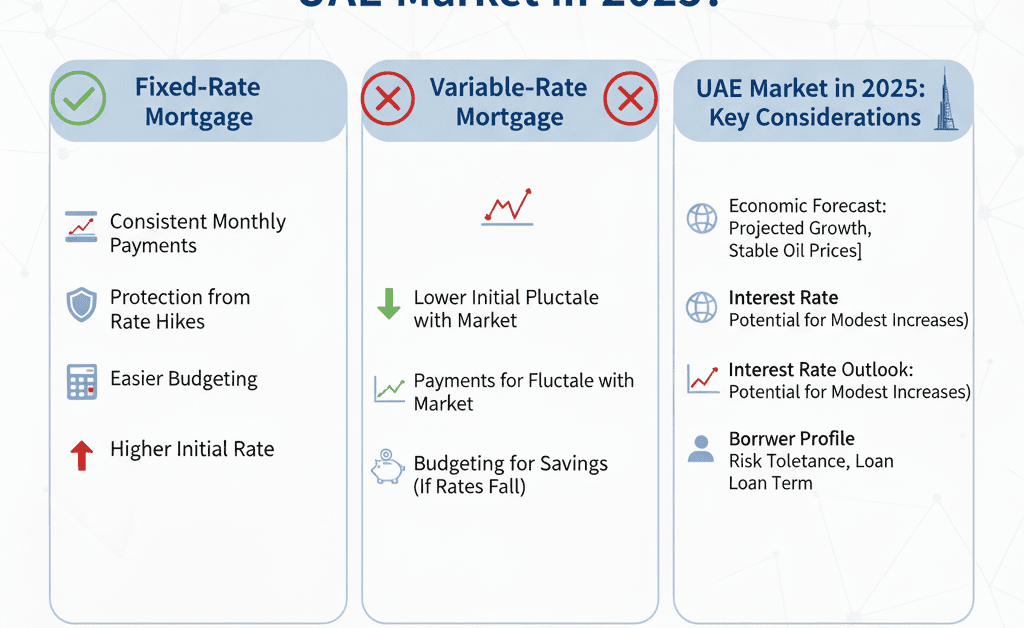

Fixed-rate mortgages are one of the most popular mortgage options in the UAE. With this type of mortgage, your interest rate remains unchanged for a specified period, typically between three to ten years.

Benefits of Fixed Rate Mortgages

Stability is the main advantage here. Knowing exactly what your monthly payments will be for the duration of your mortgage allows for better budgeting and financial planning.

Fixed-rate mortgages are particularly appealing during times of economic uncertainty, as they protect borrowers from potential interest rate hikes.

Drawbacks of Fixed Rate Mortgages

However, this stability comes at a cost. Fixed-rate mortgages often have higher initial interest rates compared to variable rates. Additionally, if interest rates decrease, you may miss out on lower payments, locking you into a higher rate.

The Lowdown on Variable Rate Mortgages in the UAE

Variable-rate mortgages, also known as adjustable-rate mortgages, offer a different approach. With this option, your interest rate can fluctuate based on market conditions, typically tied to a benchmark rate.

Why Opt for Variable Rate Mortgages?

One of the most significant advantages of variable-rate mortgages is their lower initial rates. This can mean lower monthly payments at the beginning of the loan term, which can be attractive for many homebuyers.

Variable rates can also appeal to those who plan to sell or refinance before the rates adjust significantly. If the market remains stable or decreases, you could save a considerable amount over time.

Potential Risks of Variable Rate Mortgages

On the flip side, the unpredictability of variable rates can lead to increased payments in the future, depending on market fluctuations. This uncertainty can be stressful for borrowers, especially if they are on a tight budget.

Key Considerations When Choosing Between Fixed and Variable Rates

When weighing your options for mortgage options in the UAE, several factors come into play.

Your Financial Situation

Assess your financial health. If you have a stable income and can handle fluctuating payments, a variable rate might be an exciting option. Conversely, if you prefer predictability in your finances, a fixed rate may suit you better.

Market Conditions

Keep an eye on the economic landscape. In a low-rate environment, locking in a fixed rate can be beneficial. However, if rates are high and expected to drop, a variable rate could save you money in the long run.

Duration of Stay

Consider how long you plan to live in the property. If you are likely to stay for just a few years, a variable rate may be advantageous. If you plan to settle down long-term, a fixed rate could provide the stability you need.

Tips for Evaluating Mortgage Options in the UAE

Choosing between fixed and variable rates doesn’t have to be a daunting task. Here are some tips to help you navigate your options.

Research and Compare Offers

Take the time to research various lenders and their offerings. Different banks and financial institutions may have varying rates and terms, so it pays to shop around.

Consult with a Mortgage Advisor

Consider speaking with a mortgage advisor who understands the UAE market. They can provide personalized advice based on your financial situation and help you navigate the nuances of each mortgage type.

Understand the Terms and Conditions

Always read the fine print. Understanding any fees, penalties, and terms associated with your mortgage can help you avoid surprises down the line.

How to Make the Right Decision for Your Situation

The choice between fixed and variable rates is ultimately a personal decision that should align with your financial goals.

Evaluate Your Risk Tolerance

Understanding your comfort with risk is crucial. If you’re uncomfortable with the idea of fluctuating payments, a fixed-rate mortgage might be the way to go.

Think Long-Term

Consider your long-term financial plans. If you anticipate significant changes in income or expenses, this could influence your choice of mortgage type.

Factor in Future Market Trends

While predicting the market can be tricky, keeping an eye on economic indicators can provide insights into what might happen with interest rates in the future.

Conclusion: Making the Best Choice for Mortgage Options in the UAE

Navigating mortgage options in the UAE—specifically the choice between fixed and variable rates—requires careful consideration of your personal financial situation, market conditions, and long-term goals. Each option has its advantages and disadvantages, making it essential to weigh them against your unique circumstances. By taking the time to research and evaluate, you can make a well-informed decision that aligns with your financial aspirations.

Written by

Do follow UAE Stories on Instagram:

Link: https://www.instagram.com/uaestoriesofficial