Your Ultimate Step-by-Step Guide to Buying Property in Dubai

Buying property in Dubai is an exciting venture filled with potential rewards. Whether you’re looking for a vacation home, an investment opportunity, or a permanent residence, understanding the local property market and legalities is crucial. This step-by-step guide to buying property in Dubai will help you navigate the process with ease and confidence.

Unlock the Secrets: Why Invest in Dubai Real Estate?

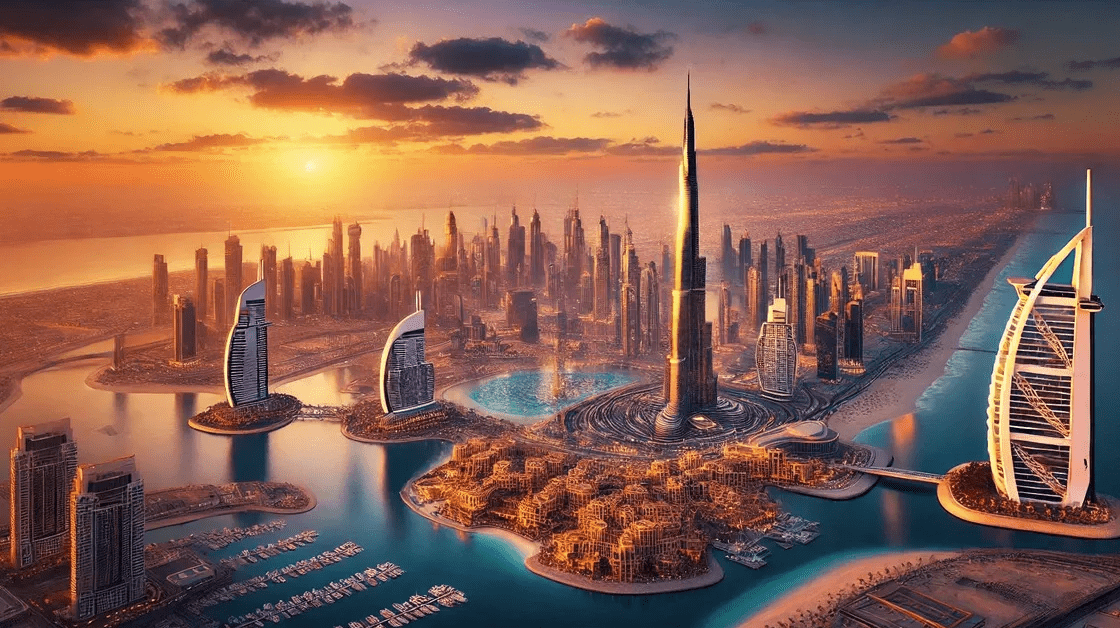

Dubai’s real estate market is one of the most dynamic and lucrative in the world. With its tax-free environment, modern infrastructure, and a constantly growing economy, investing in property here can yield significant returns. Additionally, the city’s diverse culture, stunning architecture, and year-round sunshine make it an attractive place to live or visit.

Step 1: Researching the Market Like a Pro

Before diving into the property market, take time to research. Familiarize yourself with different neighborhoods, property types, and current market trends. Areas like Dubai Marina, Downtown Dubai, and Palm Jumeirah are popular, but emerging areas may offer better value for money.

Consider factors such as proximity to schools, hospitals, shopping, and transportation. Understand the average property prices, rental yields, and demand in your chosen area. This research will empower you to make informed decisions.

Step 2: Understanding the Legal Framework

Navigating the legal aspects of buying property in Dubai can seem daunting, but it’s vital for a smooth transaction. Foreigners can buy property in designated areas known as freehold zones. It’s essential to understand the rules surrounding property ownership, which can vary depending on whether you’re purchasing residential or commercial real estate.

Consulting with a local real estate lawyer can provide clarity on the legal requirements, ensuring you meet all conditions for property purchase. They can also help you understand the associated fees, including registration and transfer fees.

Step 3: Financing Your Dream Home

Financing is a critical step in the property-buying process in Dubai. There are various options available for financing your purchase. If you’re a cash buyer, you can make the purchase outright. However, many buyers opt for a mortgage, which can be obtained through local banks or financial institutions.

Be prepared to provide financial documentation and a down payment, which typically ranges from 20% to 25% of the property’s value. Understanding your budget will help you narrow down your options and avoid overspending.

Step 4: Collaborating with a Real Estate Agent

Engaging a reputable real estate agent can save you time and effort. A knowledgeable agent can guide you through the buying process, provide insight into the local market, and help you find properties that meet your criteria.

When choosing an agent, look for someone with a strong track record and excellent reviews. They should be familiar with the neighborhoods you’re interested in and have experience working with international buyers.

Step 5: Property Viewings and Assessments

Once you’ve identified potential properties, it’s time to schedule viewings. This step is crucial in assessing the suitability of each property. Pay attention to the condition of the property, the amenities available, and the overall vibe of the community.

After selecting a property, consider hiring a professional inspector to evaluate its condition. This assessment can help identify any hidden issues that could affect your investment.

Step 6: Making an Offer: The Art of Negotiation

When you find the perfect property, it’s time to make an offer. Your real estate agent can assist you in crafting a competitive offer based on market analysis and the property’s condition. Be prepared for negotiations, as sellers may counter your initial offer.

Once both parties agree on the price, a Memorandum of Understanding (MOU) is signed, outlining the terms of the sale. This document serves as a preliminary agreement before the formal sale contract is drafted.

Step 7: Finalizing the Sale: The Exciting Closing Process

After signing the MOU, it’s time to finalize the sale. Your lawyer will draft the official sale agreement, which includes all terms, conditions, and payment schedules. It’s crucial to review this document thoroughly before signing.

During this stage, you’ll also need to pay the required fees, including the Dubai Land Department registration fee, which is usually 4% of the property value. Once the sale is completed, you will receive the title deed, marking you as the official owner of the property.

Step 8: Settling In: Moving and Managing Your Property

Congratulations! You’ve successfully purchased property in Dubai. The next step is moving in or preparing the property for rental if it’s an investment. If you plan to rent the property, consider hiring a property management company to handle tenant relations and maintenance.

Additionally, familiarize yourself with the community and local amenities. Building relationships with neighbors can enhance your living experience in Dubai.

Conclusion: Your Journey to Property Ownership in Dubai

Navigating the process of buying property in Dubai may seem overwhelming, but with this step-by-step guide, you’re well on your way to making informed decisions. From researching the market to finalizing the sale, each step is crucial in ensuring a successful investment.

Take your time, seek professional advice when needed, and enjoy the journey of owning a piece of this vibrant city. Whether you’re looking for a home, an investment, or a vacation spot, Dubai offers endless opportunities for property buyers.

Written by

Do follow UAE Stories on Instagram:

Link: https://www.instagram.com/uaestoriesofficial