Botim Money UAE fintech cashless economy is transforming the financial sector across the United Arab Emirates. As the country aims to move toward a fully digital payment system, platforms like Botim Money are at the forefront of this shift. They are making it easier for individuals and businesses to embrace digital finance and reduce dependence on cash.

A Unified Financial Platform

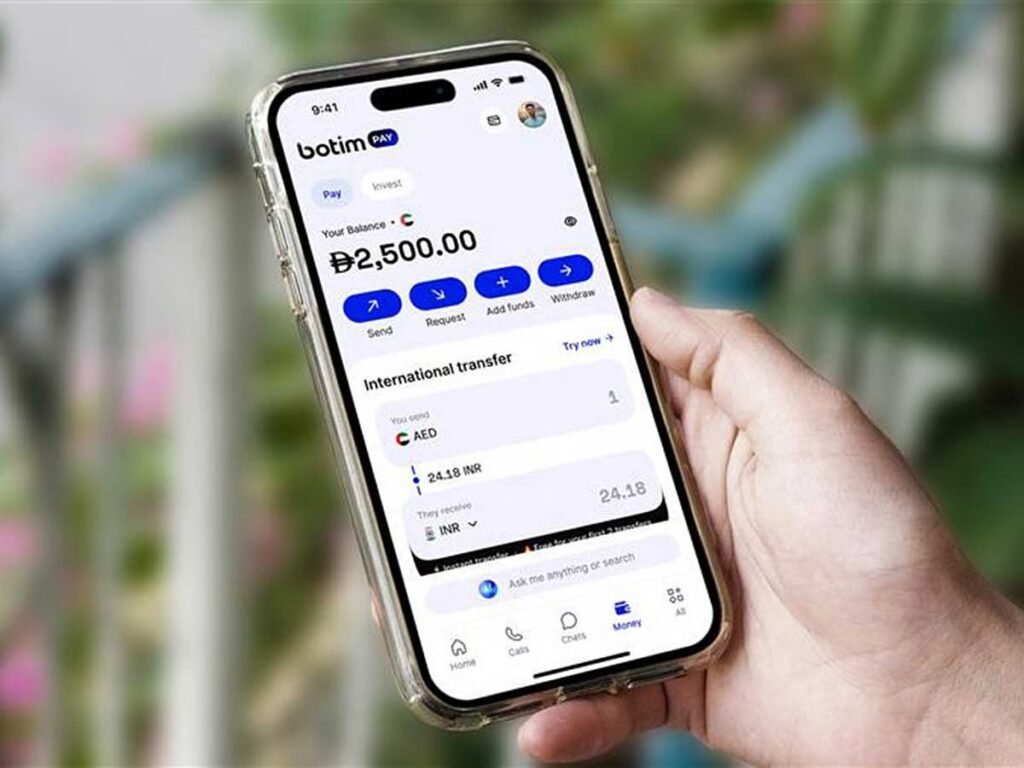

Botim Money offers a wide range of financial services under a single platform. Users can send money locally and internationally, invest in gold, manage payments, and access digital banking solutions. Its intuitive design and secure infrastructure ensure that all transactions are safe and convenient.

The platform brings together multiple services to create a seamless financial ecosystem. By doing so, it addresses the needs of both individual users and businesses, simplifying transactions that were once complex and time-consuming.

Key Features of Botim Money

Instant Money Transfers

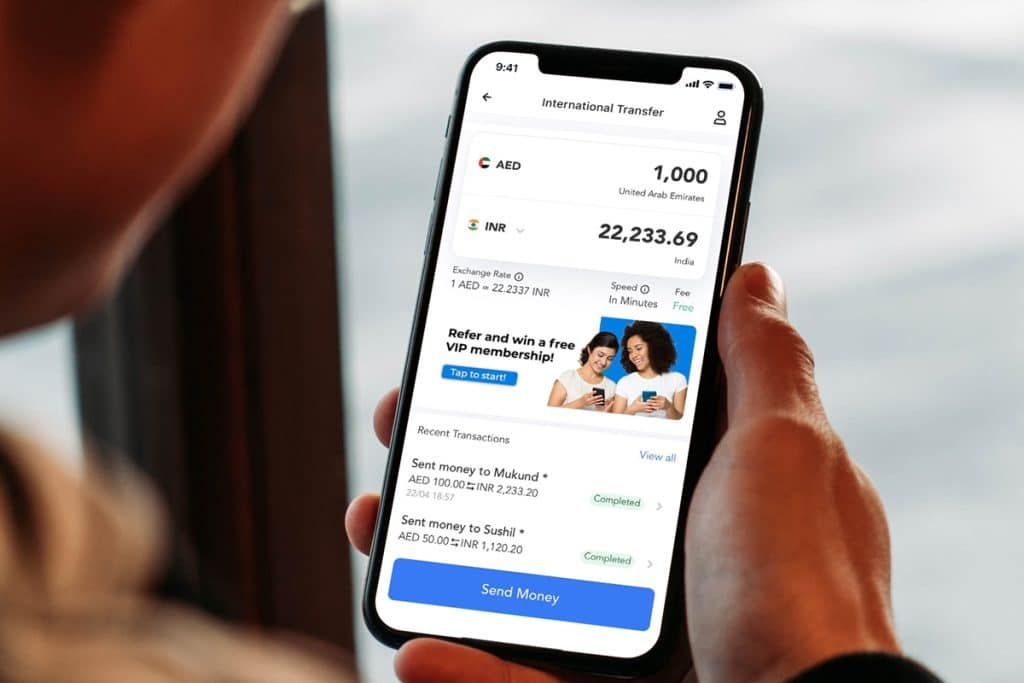

Botim Money allows users to send money instantly within the UAE or abroad. Transactions can be completed in seconds using a mobile number, email, or QR code. This convenience ensures that users no longer have to rely on traditional banking channels for urgent transfers.

Prepaid Debit Cards

The platform offers prepaid debit cards, allowing users to make cashless payments online or in-store. This step aligns with the UAE government’s goal of increasing digital payment adoption and supporting a cashless economy. Users can enjoy the flexibility of using the card for everyday purchases while avoiding the need to carry cash.

Investment Opportunities

Botim Money also introduces investment options, including fractional gold ownership. This feature makes it possible for users to invest in gold directly through the platform, opening new avenues for wealth growth and financial planning. By integrating investment and payment solutions, Botim Money empowers users to manage multiple aspects of their financial lives in one place.

Business Payment Solutions

For businesses, Botim Money provides an array of payment solutions such as online payment gateways, point-of-sale systems, and QR code payments. These tools enable merchants to accept digital payments from customers with ease. The platform also incorporates advanced security features, minimizing risks associated with fraud and ensuring secure financial transactions.

Supporting the UAE’s Cashless Vision

The UAE has a clear vision of becoming a fully cashless society. The Dubai Cashless Strategy aims to make over 90% of payments across government and private sectors digital by 2026. Platforms like Botim Money are critical in achieving this vision. They provide the infrastructure, security, and user-friendly features needed to encourage widespread adoption of digital payments.

By offering fast, secure, and versatile financial services, Botim Money reduces reliance on cash and promotes the benefits of a cashless economy. Users gain convenience, safety, and the ability to manage money anytime, anywhere.

Expanding International Reach

Botim Money is also expanding its services to support cross-border transactions. Strategic partnerships with banks in other countries allow users to transfer money internationally with minimal hassle. Recipients can receive funds in their local currency directly into bank accounts or mobile wallets. This global reach enhances the platform’s appeal for residents and businesses operating in multiple countries.

Driving Financial Inclusion

Beyond convenience, Botim Money contributes to financial inclusion. By simplifying access to digital financial services, the platform ensures that a wider segment of the population can participate in the financial ecosystem. Individuals who previously relied on cash now have an accessible, secure, and efficient way to manage their finances digitally.

Financial inclusion is not only important for individuals but also for the broader economy. With more people adopting digital financial solutions, economic growth and modernization are accelerated.

Future Prospects

The fintech landscape in the UAE is evolving rapidly, and Botim Money is positioned as a leader in this transformation. As more services are integrated, the platform is likely to introduce additional features such as microloans, automated savings, and advanced investment tools. These enhancements will further strengthen its role in building a cashless economy.

The UAE’s commitment to digital innovation, combined with platforms like Botim Money, signals a future where cashless transactions become the norm. Businesses, consumers, and investors all stand to benefit from this shift toward digital finance.

Conclusion

Botim Money is revolutionizing UAE fintech by providing innovative, secure, and convenient financial solutions. By enabling instant transfers, offering prepaid debit cards, supporting investments, and providing business payment tools, it is helping to pave the way for a fully cashless economy. As the UAE moves closer to achieving its digital vision, Botim Money will continue to play a central role in transforming the way people and businesses manage money.

Do follow UAE Stories on Instagram

Read Next – Historic Moment: UAE Golfers Aim for Glory in Asia-Pacific Tournament