The use of digital remittance apps in UAE and Saudi Arabia is growing rapidly, according to a recent report highlighting changing consumer behavior across the Gulf. Millions of expatriates in these countries are shifting from traditional money exchange houses and bank counters to mobile apps that offer faster, cheaper, and more secure transfers.

This trend is transforming the financial landscape in the region and making cross-border remittances more efficient and accessible.

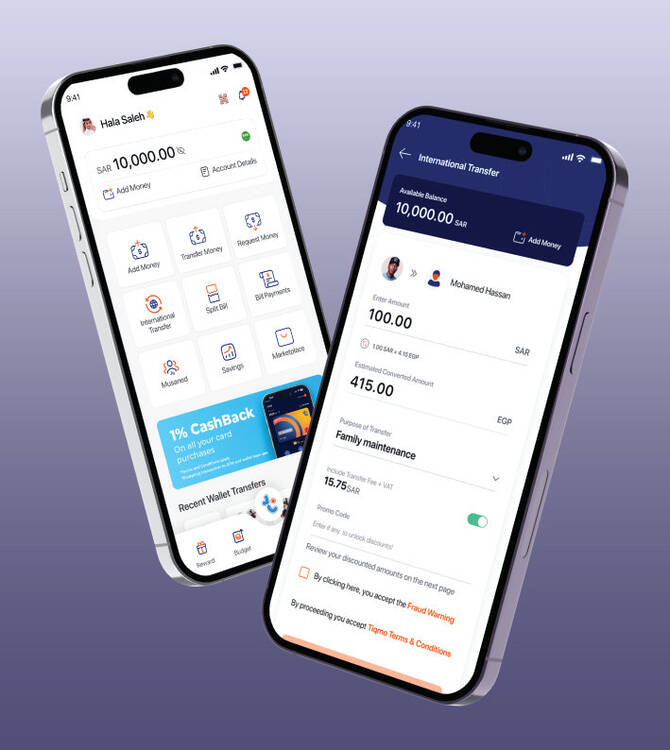

Why More People Are Choosing Digital Remittance Apps

For decades, remittance services in the Gulf were dominated by physical exchange houses. Migrant workers often waited in long lines to send cash back home. While these outlets remain popular, the shift to digital is gaining speed due to several reasons.

- Convenience: Mobile apps allow transfers in minutes without visiting a branch.

- Cost savings: Transaction fees are often lower, and exchange rates more competitive.

- Speed: Transfers through apps can be completed instantly or within hours.

- Security: Biometric logins, encryption, and regulatory oversight make digital safer.

- Smartphone use: Both the UAE and Saudi Arabia have some of the highest smartphone penetration rates worldwide.

Younger expatriates and tech-savvy professionals, used to digital banking in their home countries, are leading this shift.

UAE: A Global Hub for Digital Transfers

The UAE is among the largest remittance-sending countries in the world. With over 85 percent of its population made up of expatriates, the need for reliable transfer channels is constant.

In recent years, the UAE Central Bank has supported fintech growth by issuing licenses and setting regulations that encourage innovation. As a result, digital providers such as Wise, Remitly, Payit, and Al Ansari’s digital app have expanded their reach.

Many residents now prefer these platforms over traditional counters. Even exchange houses are adapting, offering both physical services and mobile apps to retain customers.

Saudi Arabia: Embracing Digital Finance

Saudi Arabia, home to one of the largest expatriate populations in the region, is also seeing strong adoption of digital remittance apps. The government’s Vision 2030 strategy encourages digital payments as part of its plan to create a cashless society.

The Saudi Central Bank has approved licenses for multiple providers. Platforms such as STC Pay and Tahweel Al Rajhi have quickly become household names, offering fast and affordable transfers through mobile apps.

Saudi Arabia aims for 70 percent of all transactions to be digital by 2030, making remittance apps a vital part of its economic transformation.

Key Findings From the Report

The report that analyzed consumer behavior in the Gulf revealed several key points.

- Over half of UAE expatriates now use digital remittance apps at least once per month.

- Saudi Arabia has doubled the number of digital transactions in the last three years.

- Users save an average of 20 to 30 percent on fees compared to traditional services.

- Younger workers are leading adoption with mobile-first preferences.

- Government regulation and fintech support are accelerating the transition.

These findings confirm that digital apps are moving from being an alternative option to becoming the default choice.

Benefits for Users

The rise of digital remittance apps in UAE and Saudi Arabia is not only about technology but also about practical benefits.

- 24/7 availability without being tied to branch hours

- Transparency in showing exchange rates before confirming transfers

- Reduced risk since users no longer need to carry cash

- Wider global coverage with access to dozens of countries

- Inclusion for workers without access to traditional banks

These advantages have made digital platforms attractive to both blue-collar workers and young professionals.

Remaining Challenges

Despite the growth, some barriers still exist.

- Not all workers have the digital literacy to use mobile apps confidently.

- Trust issues remain for some, who prefer dealing face-to-face at exchange houses.

- Reliable internet connections are required for smooth transactions.

- Stronger regulation is needed to protect consumers and prevent fraud.

Governments and companies are working on solutions, such as awareness campaigns, simplified user interfaces, and improved mobile infrastructure.

How Traditional Players Are Adapting

Traditional exchange houses are not standing still. Instead, many are investing in digital transformation.

For example, Al Ansari Exchange launched a mobile app that has seen strong adoption. UAE Exchange, now rebranded as Unimoni, has developed digital-first services. Major banks such as Emirates NBD in the UAE and Al Rajhi Bank in Saudi Arabia have also improved their digital transfer platforms.

This hybrid approach helps customers transition gradually, offering them the choice of visiting branches or using apps.

The Future of Digital Remittances

The shift to digital remittance apps in UAE and Saudi Arabia is expected to accelerate in the coming years. Experts forecast that over 70 percent of remittances in the UAE will be processed digitally by 2030. In Saudi Arabia, adoption will continue to align with its national digital transformation strategy.

Several future trends are likely to shape the industry:

- Expansion of partnerships between fintech startups and exchange houses

- Integration of artificial intelligence and blockchain to cut costs and speed up transfers

- Personalized financial services linked to remittance apps, such as savings accounts or microloans

- Greater financial transparency and inclusion for workers

This evolution will position the Gulf as a leader in digital financial services, benefiting both consumers and the wider economy.

What It Means for Consumers and Businesses

For individuals, the rise of digital remittance apps means faster, cheaper, and more secure ways to send money. They also gain access to additional financial services previously out of reach.

For businesses and the economy, the shift reduces operational costs, increases transparency, and encourages innovation in the financial technology sector. It also aligns with national visions to modernize financial ecosystems.

Conclusion

The rise of digital remittance apps in UAE and Saudi Arabia is more than just a convenience. It marks a major shift in how cross-border money transfers are handled. Supported by government initiatives, strong smartphone usage, and consumer demand, digital apps are quickly becoming the standard for remittances.

As adoption grows, both countries are set to become regional leaders in financial technology, offering faster and more efficient services to millions of expatriates.

Do follow UAE Stories on Instagram

Read Next – Grandiose GrandChef AI Powered Shopping Transforms Grocery Experience