In recent years, the United Arab Emirates (UAE) has taken big steps toward becoming a digital-first nation. From paperless governance to smart cities, the country’s tech evolution is impressive. One of the latest moves in this journey is a UAE digital authentication shift: moving away from traditional SMS and email one-time passwords (OTPs).

But why is this happening? What’s wrong with SMS and email OTPs? And what’s replacing them? Let’s break it down in a simple and easy-to-understand way.

What Are OTPs and Why Were They Popular?

One-Time Passwords (OTPs) are temporary codes sent to your mobile phone via SMS or to your email. They’re used as a second layer of security, known as two-factor authentication (2FA).

For years, OTPs were seen as a good way to confirm your identity when logging into accounts, making payments, or accessing sensitive data. They became a part of everyday digital life.

Why they worked well:

- Easy to use and understand

- No need for special apps

- Widely accepted and quick to set up

The Problems With SMS and Email OTPs

As technology improved, so did cyber threats. While SMS and email OTPs added a layer of protection, they also opened doors to new types of fraud and hacking.

1. SIM Swap Attacks

In a SIM swap, a hacker tricks a telecom company into giving them control of your phone number. Once they do, they can receive all your OTPs and access your bank accounts, email, or social media.

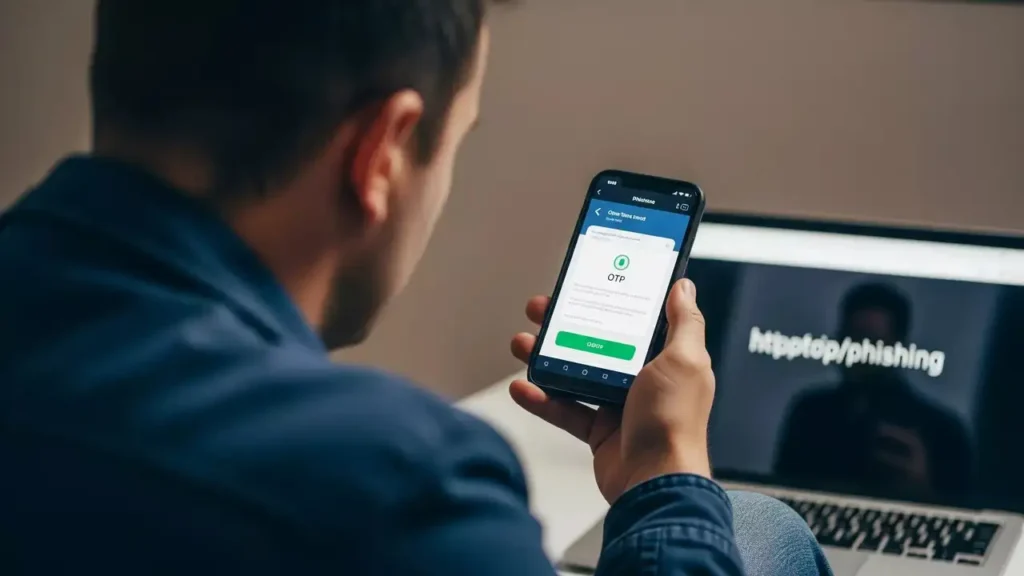

2. Phishing Emails and SMS

Hackers can trick users into clicking fake links that collect OTPs in real-time. It’s surprisingly easy to fall into such traps, especially during high-stress moments like banking or urgent transactions.

3. Delayed or Missing OTPs

Sometimes OTPs don’t arrive on time or at all. Network issues, inbox overload, or spam filters can make it hard for users to get the OTPs they need.

4. Not Secure Enough

Email accounts can be hacked. SMS messages can be intercepted. These older technologies simply don’t meet the high security needs of today’s digital world.

Why the UAE Is Leading the Digital Authentication Shift

The UAE has long positioned itself as a pioneer in digital innovation. Its leaders understand that digital trust is key to national security and economic growth.

Here’s why the UAE digital authentication shift is happening now:

1. National Digital Transformation Vision

The UAE has a clear goal: become one of the most digitally advanced countries in the world. Moving away from outdated methods like SMS and email OTPs is a step toward a more secure and seamless future.

2. Government Push for Advanced ID Solutions

The government already introduced advanced systems like UAE Pass, a secure national digital identity. This app lets users log in to government and private services without needing OTPs.

3. Rising Cyber Threats in the Region

Middle Eastern countries, including the UAE, have seen a sharp rise in cyberattacks. Moving to safer authentication methods helps protect both individuals and organizations.

What’s Replacing SMS and Email OTPs in the UAE?

Let’s look at the safer, smarter alternatives the UAE is embracing.

UAE Pass

A government-backed digital identity app. It’s linked to your Emirates ID and uses strong authentication methods like biometrics and device-based approvals.

Key features:

- Face or fingerprint authentication

- Secure login to over 6,000 services

- No OTP needed

- Works across government and private platforms

Biometric Authentication

Many banks and fintech apps are now using fingerprint or facial recognition for login and transactions. These are built into smartphones and nearly impossible to fake.

App-Based Authenticators

Apps like Google Authenticator and Microsoft Authenticator generate time-based codes that are more secure than SMS or email OTPs. They work offline and are tied to your device.

Push Notifications for Approval

Instead of entering an OTP, users receive a notification asking them to approve a login or transaction. It’s faster and more secure.

Industries Driving the Change

Several sectors in the UAE are moving rapidly to adopt newer authentication systems.

1. Banking and Finance

UAE banks like Emirates NBD, ADCB, and Mashreq are phasing out SMS OTPs in favor of in-app authentication, biometrics, and push notifications.

2. E-Government Platforms

Smart Dubai and other government platforms now encourage users to log in using UAE Pass or digital certificates instead of OTPs.

3. Telecom and Utilities

Companies like Etisalat and DEWA are also adopting device-based authentication, reducing their reliance on SMS messages for user verification.

4. Healthcare and Education

Hospitals and universities are incorporating secure login methods, especially as digital health records and online learning platforms become more common.

Benefits of the UAE Digital Authentication Shift

This move brings a lot of advantages for both users and service providers.

For Users:

- Faster and smoother login experience

- Reduced risk of identity theft

- More control over personal data

- No need to worry about OTP delivery issues

For Businesses and Governments:

- Lower risk of fraud and data breaches

- Fewer customer complaints about OTP delays

- More trust from users and investors

- Better compliance with international cybersecurity standards

Challenges and Considerations

Like any big change, this shift comes with its own challenges:

- Digital literacy gaps: Not everyone is comfortable using apps like UAE Pass or setting up authenticator tools

- Device dependency: If your phone is lost or stolen, you could be locked out of your accounts

- Initial setup effort: Setting up biometrics or UAE Pass takes a few extra steps compared to receiving a simple SMS

But the UAE is working hard to overcome these hurdles through public awareness campaigns and improved user support.

How Can You Prepare for the Change?

If you live in the UAE or use UAE-based services, here are some steps to get ready:

- Download and activate UAE Pass

It takes just a few minutes and gives you access to thousands of services - Enable biometric login

Use fingerprint or facial recognition on your phone whenever possible - Switch to authenticator apps

Try Google Authenticator, Authy, or your bank’s in-app approval system - Stay alert for scams

As older OTP methods are phased out, expect new kinds of phishing attempts. Always double-check URLs and sender names - Update your contact details

Ensure your phone and email records are current in all your key accounts for easier transition

The Road Ahead: A Safer Digital UAE

The UAE’s move away from SMS and email OTPs isn’t just about better technology. It’s about creating a secure, seamless, and future-ready digital environment.

With tools like UAE Pass, biometric logins, and app-based verification becoming the norm, users can look forward to a safer and faster online experience.

This UAE digital authentication shift marks the beginning of a smarter era in digital identity. While the transition may take some getting used to, the long-term benefits are undeniable.

As more countries watch and learn from the UAE’s example, we could be witnessing the global decline of OTPs and the rise of something much stronger.

Do follow UAE Stories on Instagram

Read More: GTA 6’s Shocking Cost Surpasses Burj Khalifa — Here’s Why