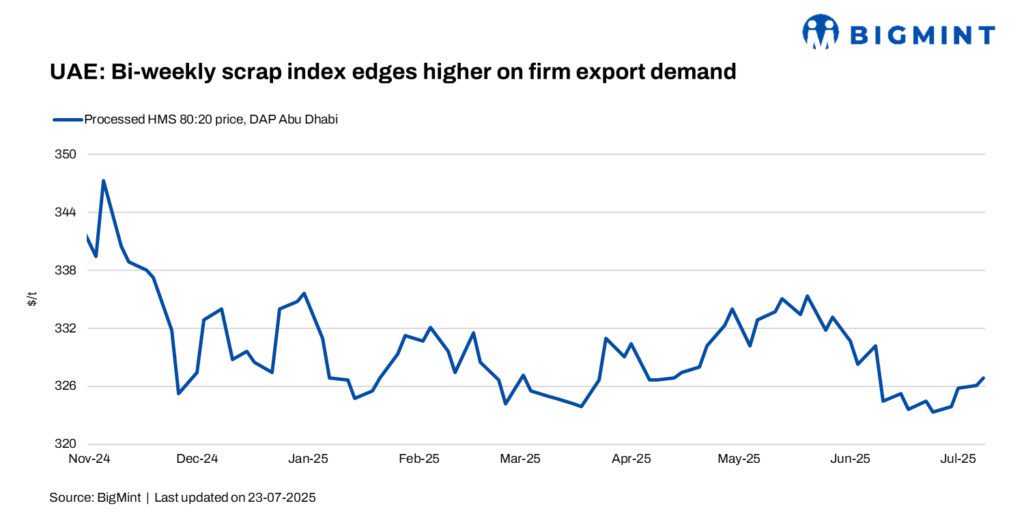

Scrap Market in UAE Sees Positive Movement

The domestic ferrous scrap market in the United Arab Emirates saw a modest but meaningful boost this week, with prices inching up by $1 per tonne on a week-on-week basis. While the increase may appear marginal on paper, it’s a strong signal of renewed momentum in the region’s steel recycling industry.

Traders and processors across the UAE are observing a change in tone. After a slow period marked by price stagnation and muted buying, there’s now a growing sense of optimism, thanks in part to rising demand from key importing nations—especially Pakistan.

Export Demand from Pakistan Brings Fresh Energy

The main driver behind this slight uptick is firm interest from Pakistani buyers. Mills and importers in Pakistan have started looking more actively toward the UAE for sourcing ferrous scrap, pushing up both inquiries and bidding levels. This renewed appetite for raw materials is closely tied to improving steel production forecasts and better liquidity conditions in the Pakistani market.

Industry insiders note that this interest is not only helping stabilise prices in the UAE but also lifting trader confidence. “It’s not just about the dollar increase. It’s the signal that external buyers are coming back strongly,” said one Dubai-based scrap trader.

Supply Tightness Supports Price Stability

The local market has also seen a slight tightening in supply. With some collectors holding back stock in anticipation of better pricing and limited inflow from collection yards, availability of clean and process-ready scrap has dropped slightly. This supply-side support is further helping domestic processors maintain a stronger price position.

Even as temperatures soar across the Gulf region, affecting collection and transport efficiency, the scrap market seems to be holding its ground. With smaller volumes but firmer rates, yards are cautiously optimistic that the positive trend will continue.

Local Buyers Adopting Wait-and-Watch Approach

Interestingly, while exporters are showing enthusiasm, local steelmakers and foundries are largely adopting a cautious stance. Many are still working through existing inventories and are not yet aggressively restocking. However, should this bullish trend continue for another couple of weeks, domestic mills may need to reconsider their procurement strategies.

In the meantime, a quiet price war is brewing among traders trying to secure premium quality HMS 1&2 and shredded scrap. The narrowing spread between domestic and export prices is making it harder for local buyers to remain passive.

Rising Transportation Costs Add to Pressure

Logistics is another factor influencing pricing this week. Rising fuel costs and increased container freight rates have added extra layers of cost pressure. Some suppliers are now reworking their quotations to factor in higher logistics expenses, especially for bulk shipments.

This has slightly dampened enthusiasm on some lower-margin deals, but for high-grade scrap and confirmed buyers, the deals are still closing at a profitable mark. The transport challenges are also encouraging more bulk-based trading over containerised deals, as the former offers better economies of scale amid volatile fuel pricing.

Outlook: A Measured Uptrend Likely to Continue

Looking ahead, most traders and processors expect the current steady climb in prices to persist, albeit gradually. With Pakistan actively sourcing and global sentiment showing signs of strength, especially in Asia, there’s cautious optimism that the UAE scrap market may be entering a new phase of sustainable recovery.

Still, much depends on external macroeconomic factors. Exchange rates, steel billet prices in international markets, and the political climate in South Asia will all play a role in determining how far this momentum can carry.

For now, though, even a $1/t rise is being seen as a symbolic win in a market that has been under pressure for months. It reflects the UAE scrap industry’s ability to stay resilient and bounce back with even the slightest tailwind from the global market.

Scrap Collectors in UAE Feel a Ray of Hope

On the ground, the mood among scrap collectors and small-scale processors has improved. After several weeks of sluggish movement and flat rates, this week brought a flicker of positivity. “It may not change our margins overnight, but it gives us hope,” said a yard manager from Sharjah.

Many are now watching international trends closely and adjusting their pricing strategies accordingly. Some even believe that if Pakistan’s appetite remains strong, there could be a more significant price adjustment in the coming weeks.

Conclusion: Small Rise, Big Signal

While the $1 per tonne increase may not make headlines in isolation, it signals an important shift. In a market where every dollar counts, this small rise is not just a numerical change—it’s a sign that regional dynamics are turning favorable, and stakeholders in the UAE scrap sector have a reason to stay engaged and optimistic.

From traders to collectors, everyone seems aligned on one sentiment: the upward momentum, however slow, is a welcome development—and it just might be the spark the industry needed.

Do follow UAE Stories on Instagram

UAE vs NIG Dream11 Prediction Today Match 15 Pearl of Africa T20 2025