Dubai has always been at the forefront of innovation, especially when it comes to simplifying life for residents and promoting digital transformation. Now, in a move that perfectly aligns with this vision, DubaiNow — the city’s leading unified smart services app — has rolled out a groundbreaking new feature: users can now instantly access their full credit report and credit score directly within the app.

This powerful enhancement is not just a technical update; it represents a shift in how people can understand and control their financial health. In today’s fast-paced world, where every second counts, DubaiNow’s new credit score integration empowers residents to take charge of their finances with just a tap on their smartphones.

Why Knowing Your Credit Score Matters

A credit score is more than just a number. It is a financial snapshot that reflects your borrowing behavior and reliability. Banks and other lenders use it to assess whether you’re a safe bet for loans, credit cards, mortgages, or even certain rental agreements.

Having easy access to your credit report and score allows you to stay informed, identify any potential errors, and maintain strong financial health. Traditionally, accessing this information meant visiting separate platforms, submitting requests, and sometimes waiting days for a response. Now, DubaiNow has made it as simple as checking your email.

One App for Everything

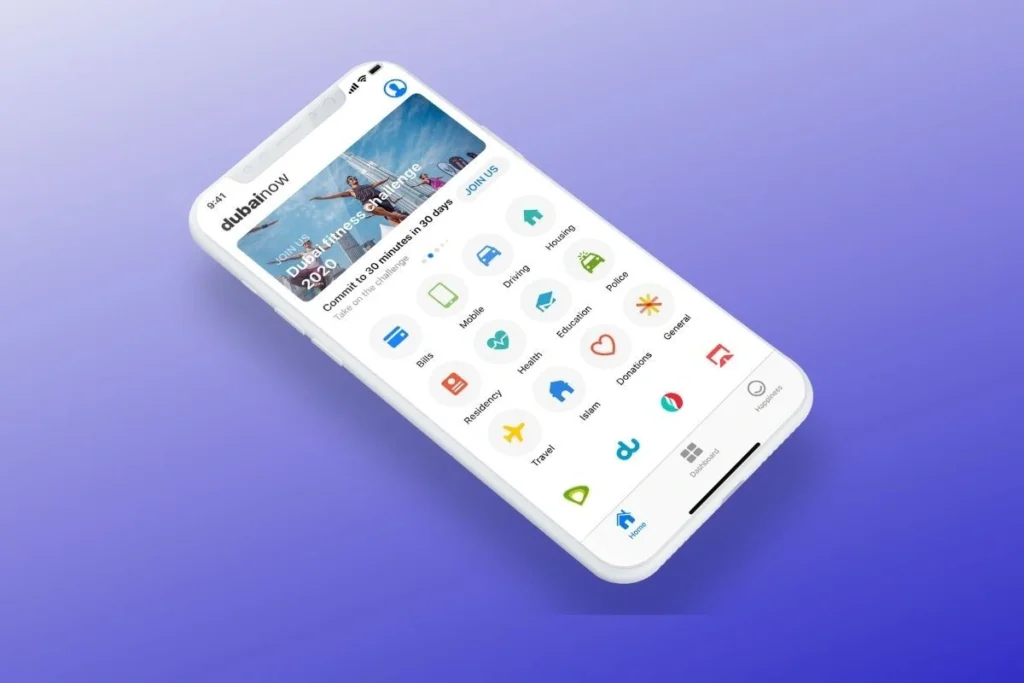

DubaiNow has always aimed to be a one-stop shop for all government and city services. With more than 300 services already available — from paying utility bills to renewing vehicle registrations — it’s the app residents rely on to manage everyday life seamlessly.

By integrating credit reports and scores, DubaiNow expands its reach into personal finance, empowering users to make informed decisions without switching between different apps or websites. This centralization reduces hassle and encourages residents to stay engaged with their financial well-being.

How Does It Work?

The new feature is designed to be as intuitive and user-friendly as possible. Users simply need to log into DubaiNow, navigate to the financial services section, and select the credit report option. Within seconds, they’ll see a detailed breakdown of their credit report, along with their current credit score.

The interface is clean, clear, and designed for maximum accessibility. Whether you’re a financial expert or someone who has never checked their credit score before, the process feels straightforward and empowering.

Encouraging Financial Literacy

Financial literacy is a crucial component of a healthy society. Yet, many people avoid checking their credit scores because they find the process complicated, intimidating, or simply inconvenient. By integrating this feature into an app people already use regularly, DubaiNow is breaking down these barriers.

This move encourages more residents to become proactive about their finances. Understanding your credit score helps you plan for big purchases, qualify for better loan terms, and avoid financial pitfalls. In the long run, this contributes to a more financially savvy and resilient community.

Boosting Confidence for Big Life Decisions

Whether you’re planning to buy a new car, move into a dream home, or start your own business, your credit score plays a critical role. It can mean the difference between securing favorable loan terms or facing high-interest rates that drain your budget.

Having immediate access to your score gives you a clearer picture of where you stand and what you can improve. This knowledge empowers you to take control, negotiate better deals, and approach major financial decisions with confidence. It transforms what used to be a mysterious figure into a transparent, actionable tool.

Security and Privacy at the Core

Whenever financial data is involved, security is non-negotiable. DubaiNow has taken robust measures to ensure users’ credit information is protected. Advanced encryption and secure authentication protocols — including biometric verification through UAE Pass — ensure that only you can access your sensitive information.

By integrating such high levels of security, DubaiNow offers peace of mind alongside convenience. Users can feel confident that their personal data will remain private, secure, and safe from potential breaches.

Aligning with UAE’s Vision for Digital Transformation

This latest feature is more than just a convenience; it’s part of a broader mission to make Dubai a fully digital, smart city. The UAE’s leadership has long prioritized innovation and technological integration to enhance quality of life, improve public services, and boost economic competitiveness.

DubaiNow’s new credit score functionality is a prime example of this vision in action. By empowering residents with tools to better understand and manage their finances, the city is investing in a more knowledgeable and empowered population.

Simplifying Life for Everyone

One of the biggest strengths of DubaiNow is its focus on inclusivity and ease of use. Whether you’re a busy professional juggling multiple responsibilities, a young entrepreneur exploring financing options, or a family managing monthly expenses, the app’s new credit score feature makes life simpler.

This accessibility helps break down financial information into manageable, digestible insights. Instead of feeling overwhelmed by financial jargon, users can understand exactly what their credit score means, what affects it, and how to improve it over time.

Saving Time and Reducing Stress

In the modern world, time is perhaps the most precious resource. The old method of obtaining your credit report involved paperwork, phone calls, and waiting periods. With DubaiNow, you can check your credit score during your morning coffee or while waiting in line at the grocery store.

This immediate access can also help prevent last-minute surprises. For example, if you’re about to apply for a home loan, knowing your credit score upfront allows you to correct inaccuracies or improve your standing before submitting your application.

Building a Culture of Transparency

By making credit scores more accessible, DubaiNow is fostering a culture of transparency and trust. Financial institutions often keep consumers at arm’s length when it comes to detailed credit information. By putting this data directly into the hands of individuals, the app helps bridge this gap and build stronger, more transparent relationships between consumers and lenders.

When people understand how their actions impact their credit scores, they are more likely to adopt responsible financial behaviors. This not only benefits individuals but strengthens the entire financial ecosystem.

A User-Centric Approach

The integration of credit reporting into DubaiNow highlights the city’s commitment to a user-first approach. Every feature is designed with the user’s convenience and needs in mind. The credit score function is seamlessly integrated, with clear explanations, easy navigation, and real-time updates.

This thoughtful design encourages more people to engage with their financial data regularly. Instead of feeling like a bureaucratic task, checking your credit score becomes a quick, empowering part of your personal finance routine.

Supporting Small Business Owners and Entrepreneurs

For small business owners and aspiring entrepreneurs, credit scores can be a make-or-break factor when seeking funding or new partnerships. Easy access to credit information can significantly simplify business planning, making it easier to strategize, secure capital, and scale operations.

DubaiNow’s feature gives business-minded individuals the data they need to present stronger cases to investors or banks. This level of financial clarity supports Dubai’s broader goals of fostering entrepreneurship and economic diversification.

Looking Ahead: The Future of Integrated Financial Services

The integration of credit scores into DubaiNow is likely just the beginning. As technology advances and user expectations continue to rise, more financial services will become accessible through unified digital platforms.

Imagine being able to simulate how your credit score might change after paying off a loan or see personalized recommendations for improving your credit health — all within the same app. These possibilities represent the future of smart financial management, and DubaiNow is already laying the foundation.

Final Thoughts: A New Era for Personal Finance

DubaiNow’s credit score and report feature marks a significant milestone in personal finance accessibility. It empowers residents to understand their financial position clearly, make informed choices, and feel more confident in their long-term plans.

By bridging the gap between financial institutions and consumers, this feature helps transform what was once an intimidating, hidden part of personal finance into a transparent and approachable tool.

As Dubai continues to innovate and lead by example, residents can look forward to even more features that make daily life smoother, smarter, and more empowering. In a city that never stops pushing boundaries, DubaiNow stands as a shining example of how technology can be harnessed to truly improve people’s lives.

Do follow UAE Stories on Instagram

Read More: Raffles The Palm Dubai: Discover an Unforgettable Summer of Luxurious Bliss